- Education

- Trading CFDs

- Why Trade CFDs

Why Trade CFDs

CFD trading is perfect due to its unique features and potential benefits. CFDs, or Contract for Difference, are a type of derivative product that allows traders to speculate on the price movements of various financial assets without owning the underlying asset itself.

In this article, we will explore what CFD trading is, why people choose to trade CFDs, and the advantages and disadvantages associated with this trading method.

KEY TAKEAWAYS

- Instead of purchasing the actual asset, traders enter into a contract with a broker based on the asset's current market price and its expected future value.

- When the contract is closed, the trader will either receive the difference between the opening and closing prices (if the trade is profitable) or pay the difference (if the trade is unprofitable).

- To succeed in CFD trading, it's essential to have a well-defined trading plan.

What is CFD Trading

CFD trading is a form of financial speculation that involves making predictions about the price movements of various assets, such as stocks, currencies, commodities, and indices.

Instead of purchasing the actual asset, traders enter into a contract with a broker based on the asset's current market price and its expected future value.

When the contract is closed, the trader will either receive the difference between the opening and closing prices (if the trade is profitable) or pay the difference (if the trade is unprofitable).

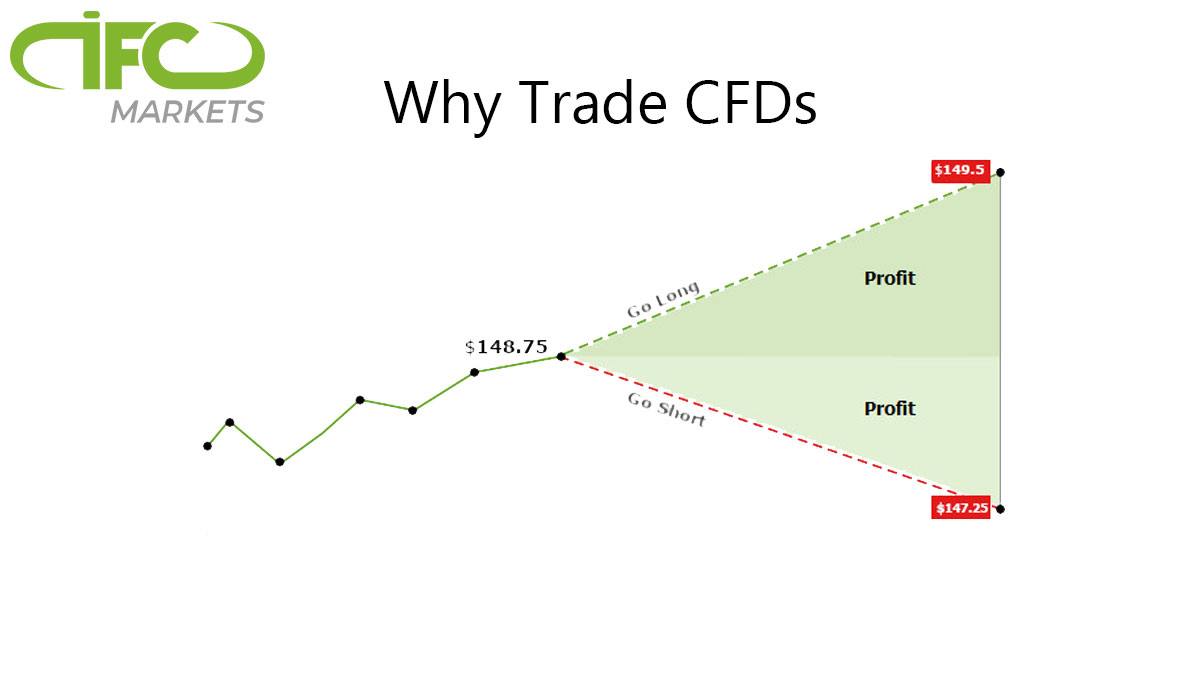

Why Trade CFDs

There are several reasons why traders choose CFDs over traditional asset trading:

Leverage

CFDs offer leverage, which means you can control larger positions with a smaller amount of capital. For example, if a broker offers a 1:10 leverage, a $1000 deposit could allow you to control positions worth $10,000. While leverage can amplify profits, it also increases potential losses, so it must be used cautiously.

Example:

Let's say you want to trade Apple stock, which is currently priced at $200 per share. Instead of buying 100 shares for $20,000, you could use a CFD with a 1:5 leverage to control the same position with only $4,000 (20,000 / 5).

Diverse Asset Selection

CFDs allow access to various asset classes like stocks, commodities, currencies, and indices, enabling traders to diversify their portfolios and take advantage of different market opportunities.

Example:

If you believe that the price of gold will rise due to economic uncertainties, you can start gold CFD trading without having to own physical gold.

Short-Selling

CFDs enable traders to profit from falling prices by short-selling an asset. This means you can sell an asset you don't own, aiming to buy it back at a lower price, thereby earning a profit.

Example:

Suppose you anticipate that Company XYZ's stock price will decline, so you sell XYZ CFDs at the current price. If the stock price drops, you can buy back the CFDs at a lower price and profit from the price difference.

No Ownership

CFD trading allows you to speculate on price movements without actually owning the underlying asset. This means you don't need to worry about storage, maintenance, or physical delivery of the asset.

Example:

If you believe that a specific currency pair will appreciate against another currency, you can trade the CFD without owning the actual currencies.

Advantages of CFD Trading

- Liquidity:CFDs are typically highly liquid, meaning there is a substantial number of buyers and sellers in the market. This allows traders to enter and exit positions quickly, even in large volumes, without significantly impacting the asset's price.

- No Expiration Dates: Unlike some other derivative products, CFDs do not have fixed expiration dates. You can keep your positions open for as long as you want, providing flexibility in managing your trades.

- Access to Global Markets: CFDs provide access to markets from all over the world, allowing traders to take advantage of opportunities in different time zones and regions.

- Hedging: CFDs can be used as a hedging tool to protect existing investments against potential losses. For instance, if you hold a portfolio of stocks, you can use CFDs to hedge against market downturns.

Disadvantages of CFD Trading

- Leverage Risk: While leverage can amplify profits, it also magnifies losses. A significant adverse price movement can lead to substantial losses that exceed the initial investment.

- Overnight Financing Costs: If you hold CFD positions overnight, some brokers charge overnight financing costs, also known as swaps. These costs can erode your profits if not carefully considered.

- Counterparty Risk: CFDs are contractual agreements between traders and brokers, which means you are exposed to counterparty risk. In the unlikely event of a broker's insolvency, you may face difficulties in recovering your funds.

- Emotional Trading: CFD trading involves real money and can evoke emotions like fear and greed, leading to impulsive decisions that might not align with your trading strategy.

Bottom Line on Why Trade CFDs

CFD trading offers numerous advantages, including leverage, asset diversification, short-selling capabilities, and no ownership requirements. However, it also comes with risks, such as leverage-induced losses, financing costs, and counterparty risk. To succeed in CFD trading, it's essential to have a well-defined trading plan, adhere to risk management strategies, and continuously educate yourself about market dynamics.

Remember that CFD trading is not suitable for everyone, and before you start, consider your risk tolerance, financial situation, and trading experience. Always seek advice from a financial advisor if you are uncertain about engaging in CFD trading.

In conclusion, CFD trading can be a powerful tool for experienced traders looking to diversify their portfolios and capitalize on various market opportunities. However, it should be approached with caution and discipline to mitigate potential risks and maximize the potential for profitable trading.