- Education

- About Forex

- Global Economic Calendar

Global Economic Calendar

The global economic calendar is trader's best assistant for trading in the financial markets. Using a calendar will only take you a few minutes a day, but those few minutes can be the key to your financial success.

Economic calendar is the most important parameter of Fundamental analysis.

First of all, it is worth understanding and remembering that the financial market is not a place for trading, but a whole system of economic relations that arose in the process of exchanging various goods and resources.

KEY TAKEAWAYS

- The global economic calendar is trader's best assistant for trading in the financial markets.

- The global economic calendar is a summary table that shows planned for publication economic news, events and statistical data that are directly related to financial markets and the economy.

- Economic calendars are widely used by traders who try to think ahead and apply a predictive approach to their trading strategy.

- It is very important to keep track of the fundamental picture for your chosen currency in the medium and long term, not forgetting the technical analysis for the short term.

What is Economic Calendar

Many professional traders use chart technical analysis in their trading practice as one of the most effective ways to predict prices. However, in many cases, the calendar of economic news is also used in the work. Its main purpose is to track events in the global economy in order to create a forecast of price movements in the forex market.

So the global economic calendar is a summary table that shows planned for publication economic news, events and statistical data that are directly related to financial markets and the economy. The most popular of these indicators are data on GDP, inflation, interest rates and the labor market.

Every week in different countries of the world, a huge amount of various data is released that affects the price of assets. It is the economic calendar that will allow you to navigate these events and find out how they can affect the market.

Let’s start from Calendar structure

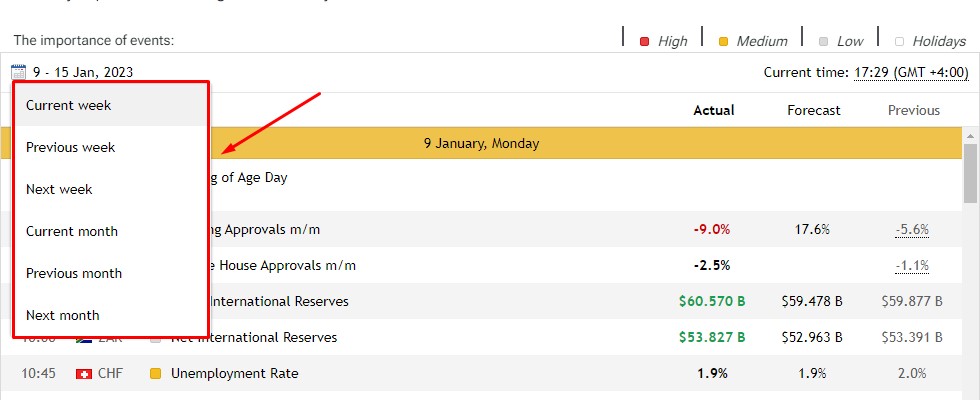

In the screenshot, we see a panel on ifcmarkets.com, where news for the past, current and next week are indicated. That is, these tabs display events that have happened, are happening now or will happen.

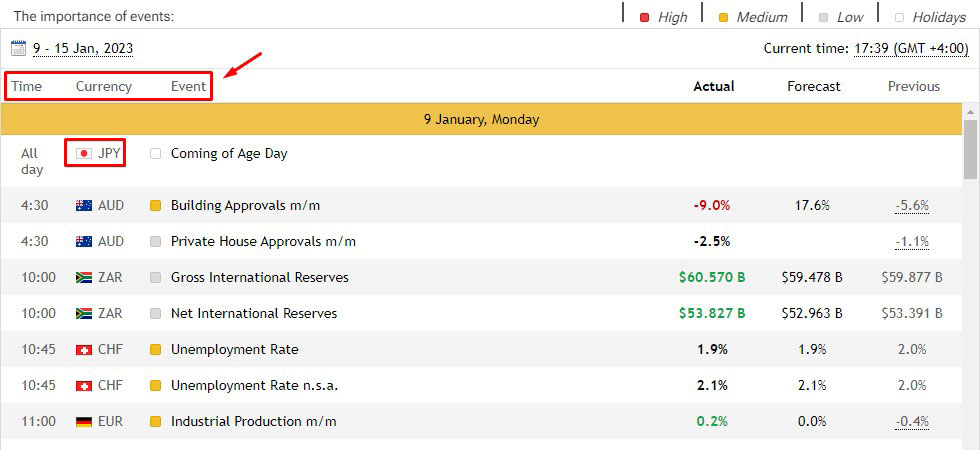

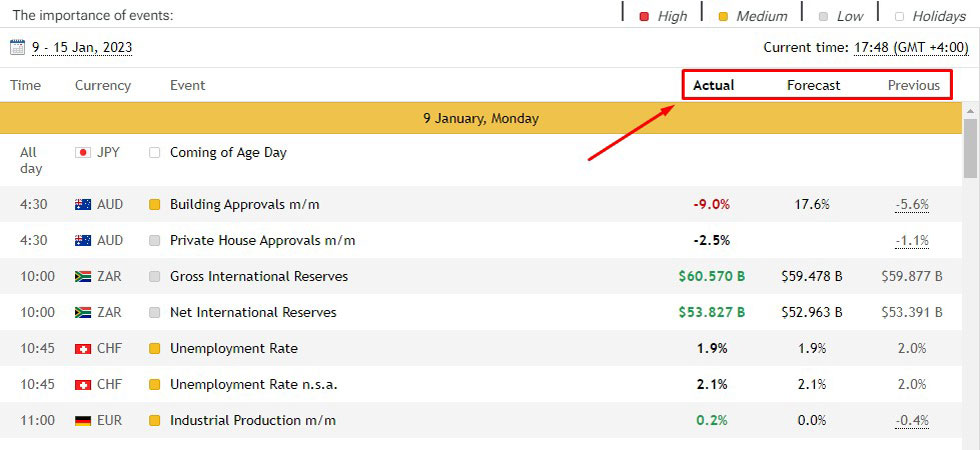

The interface is easy to understand. The date is indicated, then the time and the country for which the news is released. Or it may indicate a day off in the country due to holidays, etc., when there is neither news nor trade.

Next we see the title of the news. There are three more columns in the upper right part, where preliminary data (Previous), predicted and actual are shown, which will be displayed directly at the time of the event. Red or green indicates positive or negative news for currency pairs.

How to Read Economic Calendar

Let’s see it on example:

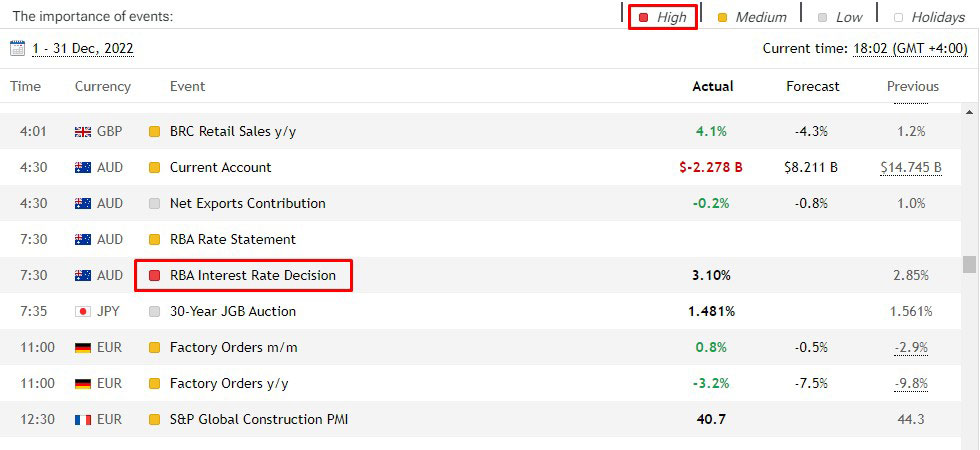

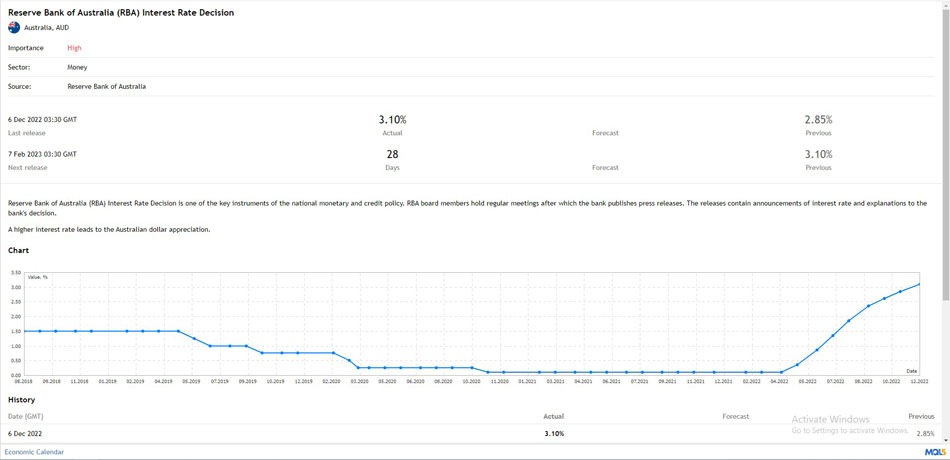

On December 6, 7:30 CET, the Australian Dollar interest rate decision event will take place ( event is marked as important - red), from the table you can see actual and previous data.

What do these data give the trader? At 7:30, an impulsive price movement is possible, for example, it could be the Australian dollar. The forecast value is not marked, and from the past data we see that the interest rate has increased, the impulse may or may not be there (in order to make a broader analysis, it is also necessary to consider events related to the change in the rate with the US dollar, etc.).

For example, if market participants are waiting for a rate cut and the decision will be in the opposite direction, that is, events will be very different from the forecast, then there will be strong volatility in the market.

Further, if we are interested in the details of this or that news, we can see the details by simply clicking on it:

You will see a description of the event, there is a graph-report for a long period of time, where you can see how the dynamics of the results of this news has changed. You can see the prospect of price movements in the near future. With the right approach, the forex economic calendar can give the trader all the necessary information for analysis.

A competent trader must be aware of what events are coming in the market. To understand why the price is moving in one direction or another, you need to know a clear schedule for news releases. Of course, the economic calendar is not a panacea and none of them will give a 100% guarantee of price direction, will not determine the trend, etc. This is just one of the tools of a successful forex trader, which, coupled with an understanding of technical analysis, will bring success.

Benefits of Using Economic Calendar

The main reason for using economic calendars is obvious:

- World economic news has a direct impact on your existing portfolio as well as the development of new trading opportunities.

The economic calendar organizes this information and provides important context to help you track events and understand their potential impact on the global forex market.

With a Global Trading Calendar at your disposal, you can take into account upcoming news and events, when planning trades and anticipating possible market changes that may occur.

Economic calendars are widely used by traders who try to think ahead and apply a predictive approach to their trading strategy.

While this forward-thinking approach is generally good for your trading strategy, it's also important not to overreact to upcoming events or the revelations of a news report just released.

Events on the economic calendar can lead to rapid volatility in a currency pair or the forex market in general, but these overreactions can lead to painful losses if you are reckless in your trading.

Remember to take a balanced approach to evaluating news as it develops and pay attention to the overall macroeconomic environment that is shaping the market for the currency pair.

When you're trying to chase quick profits by trading on the impulsive reactions of other traders, it's only a matter of time before you get burned.

Bottom Line on Global Economic Calendar

We would also like to mention that not all news events have a significant impact or are reliable indicators. When it comes to currency trading, there are a few events that have a stronger economic impact than most. You should be looking at:

- Non-farm payroll (NFP) reports

- Central Bank Decisions on Interest Rates

- Durable Goods Orders

- Retail Sales Index RSI

- CCI Consumer Confidence Index

In the end, we would like you to take with you a few important rules for working with the economic calendar. Despite the fact that there are no classical rules for working with the calendar.

- Events with high importance have the greatest impact on the market. They are not published very often, but they seriously increase volatility in financial markets and may even lead to the end of the current trend. During the publication of such events, some analysts recommend staying out of the market.

- Particular attention should be paid to the results of the meetings of world Central Banks and the speeches of their heads. Such events are the cornerstone of monetary policy, determining its future prospects. Often, the Central Banks also provide a brief analysis and forecast of the economic situation in the country, which allows you to predict the further actions of the monetary authorities, and therefore determine the approximate trend of the currency.

- In all calendars, not only the previous value of the indicator is published, but also the forecast for it. This is an important point, since the excess of the forecast has a positive effect on the positions of the currency. It is especially worth noting here that most of the indicators are not absolute values, but relative ones. For example, if the calendar says "Spain: number of unemployed, previous value 35 thousand, actual value 0" - do not believe that there are no unemployed people in Spain at all. In fact, the correct name of the indicator is “Change in the number of unemployed”, and 0 means that compared to the previous month, the number of unemployed has not changed.

- First of all, the exchange rate is influenced by the economic statistics of her country. The dollar exchange rate is influenced by statistics from the USA, the Japanese yen - from Japan. However, here it is worth paying attention to the fact that some statistics affect not only the currency of their country. For example, the publication of China's economic indicators has a direct impact not only on the currencies of its closest neighbors - the New Zealand and Australian dollars, but also on the dynamics of all risky assets, including the euro.

- For the convenience of working with the calendar, you can set certain filters to receive information only on the currencies that you trade, since a normal economic calendar covers statistics from almost all countries whose currencies are traded on the Forex market.

- For a better understanding of events, we recommend following the comments of experts who, having specialized knowledge and special skills, can more fully reveal the statistical picture and pay attention to the presence of certain nuances.

- Trading solely on fundamental analysis is the prerogative of specialists, however, a simple trader cannot do without a “foundation”. Therefore, it is very important to keep track of the fundamental picture for your chosen currency in the medium and long term, not forgetting the technical analysis for the short term.

- If you are not confident or do not have sufficient skills, it is better not to trade on the day of publication of especially important economic events.

That’s all.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.