- Analytics

- Market Overview

Last week we observed a strong weakening of emerging markets currencies - 27.1.2014

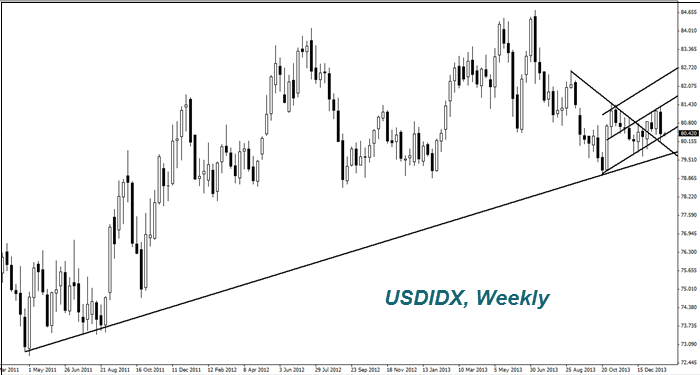

Meanwhile, the Dollar index has fallen significantly last week. We consider that some part of investors doubt that Fed will reduce bonds purchase by $10 billion. Let us remark that New Home Sales will be available at 15-00 GMT+0. For now the forecast is negative. The U.S. Dollar fell against the Japanese Yen (USDJPY) to its lowest level in seven weeks. Investors suggest that Yen is more suitable for the status of “protecting currency”. The current Japanese debt is the maximal one among emerging countries. It is over 200% of GDP. The Japanese government tends to decrease the deficit by 1.1% of GDP by 2020/21. That is why the GDP growth rate should not be less then 3%. If the GDP will increase slower, the beginning of the economical crisis in Japan is possible. The next GDP value will be updated by 17 of February. We expect that it will increase by 1.6% that is close to the lower limit of the government forecast. Today, in the morning, the trading deficit of Japan has been published – it turned out that it has been increased twice up to $112.3 billion. In general, it was caused by the increase of energy imports and Yen weakening.

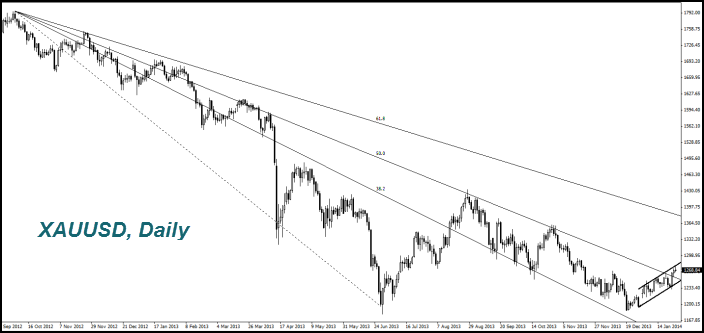

On the background of the crisis Gold has a higher demand as the main "asset protection" instrument (XAUUSD). Besides, the release of the Canadian company Barrick Gold Corp. was published: its gold reserves have been decreased by 10%. Because of the fall in world prices from $ 1,500 to $ 1,200 per ounce, some fields have become unprofitable. Note that a few miners in Canada, South America and Australia have announced about the possibility of reducing their reserves if the price of precious metals will not rise. Rise in gold prices has been observed for five weeks, the first time since September 2012. However, huge investing banks preserve pessimism regarding gold in their forecasts. They expect the fall of the prices to $1150-1050 range because of the world economy rise – see the forecast of IMF.

See Also