- Analytics

- Market Overview

US Q3 GDP upped 3.5% - 31.10.2014

World markets rose significantly on Thursday. The US Q3 GDP upped 3.5% yoy. This is more than it was expected (+3%). The main economic driver was the declined imports, and consequently, the reduced trade deficit. It was explained by the sharp reduction in oil inventories in the world market, due to the extraction growth of shale hydrocarbons in the United States.

Note that the US natural gas price is almost three times lower than in Europe, and five times less than in Japan. Such positive trends added 1.32% of the US GDP growth and 0.66% was provided by government spending, mainly on military defense. Currently, the main risk for the US economy is the further slowdown in consumer spending, which accounts for two-thirds of GDP. In the third quarter the indicator performance rose 1.8%, after the growth of 2.5% in the second quarter. Note that this kind of slowdown is observed amid the lowest unemployment rate in 14 years. Now the US GDP growth forecasts for 2014 are in the range from 2.5% to 3%.

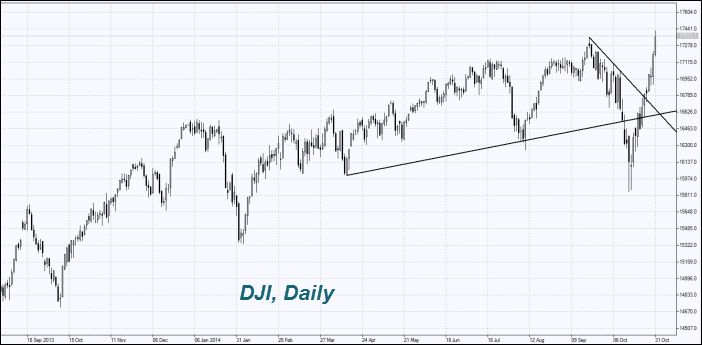

The rise of US stock indices yesterday was caused by good earnings reports of Visa and MasterCard. Their stocks rose 10.2% and 13%, respectively. Among the reported companies listed in S&P 500, 75.5% outperformed their own earnings forecasts. This is significantly higher than the long-term average of 63%. Not all the market participants reacted rapidly to the earnings reports of Visa and MasterCard released yesterday. The trading volume on the US stock exchanges was 12% below the monthly average and reached 6.9 billion stocks. Accordingly, futures on the US stock indices are now traded considerably upwards. Perhaps investors expect them to hit new historical highs. The US dollar index has been growing for the third day in a row, due to Fed’s optimistic view on the US economy and QE3 completion. Today at 12-30 СЕТ we expect the data release of the US Personal income and spending in September. Chicago PMI and Michigan Consumer Sentiment Index (MCSI) will be announced at 13-45 and 13-55 СЕТ. We assume that in general predictions are rather negative. But the data is unlikely to result in retracement amid the higher investor optimism.

Nikkei showed a strong increase and hit the 7-year high. The trading volume was 75% higher than the monthly average level. The Bank of Japan increased unexpectedly the annual volume of the money printed, intended for the purchase of Japanese government bonds, from the usual 60-70 trillion yen to 80 trillion yen. Because of this, the yen to US dollar rate has fallen to the lowest level since January 2008. Investors believe that the weak yen would have a positive influence on the Japanese exporters’ activity and increase their stock prices. The Government Pension Investment Fund reported a further increase in Japanese share stake in the portfolio, which is $1.2 trillion. This data also boosted Nikkei.

European markets are also rising in line with the global trend. This morning the inflation and unemployment rates have come out in the EU. The data coincided with the forecast. Market participants are not very active: we wait for the ECB information regarding the expected monetary policy easing.

Gold and silver prices hit the 4-year low amid the rising US dollar and US stock indices hitting the historical highs. The weekly drop in gold prices may be the largest in 16 months. Investors consider precious metals as defensive assets, and they are rising when stocks, currencies and bonds are falling down. According to SPDR Gold Trust, clients are selling gold, so its stockpiles fell to 6-year low of 741.2 tons. There was negative news from China Gold Association, which reported the reducing gold consumption in China by 21.4% in the first nine months of this year, to 754.8 tons compared with the same period of 2013. Gold production in the country upped 14.3%, and in January-September it amounted to 351.8 tons.

See Also