- Analytics

- Market Overview

US stocks continued to rise on Friday - 22.12.2014

US stocks continued to rise on Friday. S&P 500 rose for the third week and showed the maximum increase (+ 3.5%) for two last month. On Friday, no significant macroeconomic data in the US was released. Investors act out positive data from the Fed, which was released on December 17.

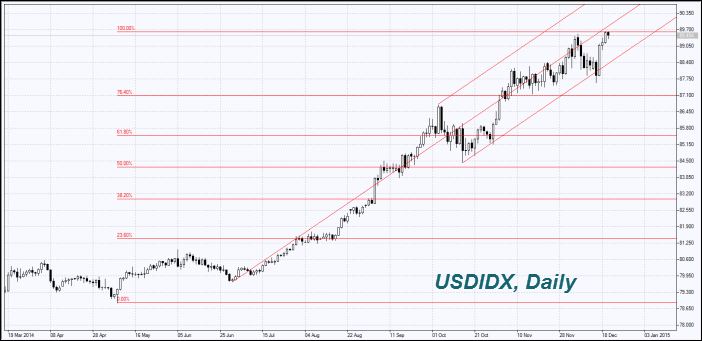

US Index approached the 90 points level. Many market participants would consider it as strong resistance. The next meeting of the ECB will be held on 22 of January. The beginning of government bonds redemption may be discussed. Today at 15:00 CET the data on secondary housing market sales will be released in US. In our opinion, the preliminary forecasts should be negative. However, futures on US stock indexes are now in a green zone. Note that on Thursday a Catholic Christmas will be celebrated and most Western exchanges will not work.

European stock indices rise. An attractiveness of stocks has increased against the background of that the Central Bank of Switzerland introduced negative interest rates. Among corporate news, we note that Daimler AG considers rising of the dividend for 2014. Prior to that, the dividend yield was estimated at 3.5% per annum. Today at 15:00 CET the Eurozone consumer confidence index will be released on December. An outlook is positive. Euro renewed a minimum for at least two and a half years on Friday. Now it is slightly strengthened against the US dollar. As market participants do not expect significant economic data from the EU by the end of the year, while the dollar index has almost reached the psychological resistance level of 90 points. We do not rule out that the dynamics of the euro could affect the results of presidential elections in Greece on 29 December.

Nikkei today grew up with other global stock indices. Japanese shares of the energy sector were leading against the background of rising oil prices. Quotes of Showa Shell Sekiy oil company soared by 25% thanks to the information on the merger with Idemitsu Kosan. Note that foreign investors provide up to 70% of the transactions volume in the Japanese stock market. Therefore, due to the Christmas holidays, trading activity can be significantly reduced. This week, a regular meeting of the Bank of Japan will be held. In addition an important macroeconomic data will be released. We do not exclude the possibility that this may affect the value of yen and the Nikkei.

Monthly review of USDA for beef was neutral, but quotations continued an upward correction. Today at 19:00 CET another review USDA will be released. It regards reserves of frozen pork and beef in the United States. According to forecasts, the reserves of frozen beef are 386.2 million pounds. The actual data can affect the quotes, if strongly deviate from the expectations of market participants.

See Also