- Analytics

- Market Overview

Greek and EU finance ministers to meet today - 20.2.2015

European stocks surged yesterday as investors expected today's finance ministers' meeting on the Greek problem. The euro fell in contrast. Market participants suggest that bailout extension may weaken the common currency. As we pointed out in December overviews, European shares apparently outpaced American ones. FTSEurofirst 300 has marked an 11% increase since the beginning of the year, compared to S&P 500 1.9% modest growth. Investors suppose that the fourth quarter will be the best over the last 3.5 years and European companies' total earnings will add 19.5%. In our opinion, earnings may have a strong impact on indices. The reports are supposed to confirm that quotes recent rally is substantiated. European Stoxx 600 is traded at its 10-year highest P/E (profit/earnings) ratio – 15.6. Today at 8:00-9:00 CET German, French and eurozone PMI will be announced by Markit. The tentative outlook is positive.

Nikkei has been growing for 4 consequent days, recording its 15-year high today. It is underpinned by such positive macroeconomic data as dropping trade deficit and rising leading indicator. More and more investors expect Japanese economy to escape recession.

Cotton futures sagged when China's National Development and Reform Commission announced that state reserve is furnished. Let us note, Xinjiang Production and Construction Corps, Chinese cotton producer, stated that it is going to keep cotton price not lower than 500 yuan ($80). This is an essential measure aimed to support local producers. According to US Department of Agriculture, this season China will consume 7.7 million tons of cotton and produce 6.2 – 6.5 million tons; the delta is to be imported. We do not exclude that cotton price will ramp up after pullback.

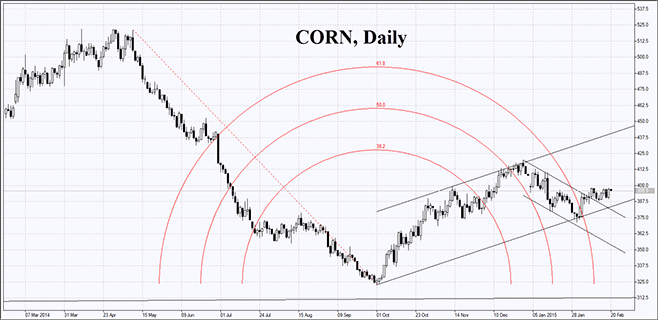

US Department of Agriculture released a weekly statement, forecasting cropland reduction for soy, wheat, corn and cotton in the season 2015/2016. Because of falling prices, cultivated areas will be cut by 3.3 mm acres in total. We point out, that Egypt refused importing American wheat, worth $100 mm, on the ground that the price was too high. It produced a negative affect on wheat futures.

Oil is cheap after Energy Information Administration announced US reserves to rise 7.7 mm barrels previous week, hitting its historical high – 425.6 mm barrels. Meanwhile oil rigs have reduced to their lowest since August, 2011. However, we do not expect another boost in oil prices. First, American oil workers' strike will end one day. Second, the new Libyan regime is going to run several oil-wells and increase oil supply to global market. We mention, that eleven refineries are on strike at the moment. They account for 13% of petroleum consumed in the USA. That well explains why crude oil reserves are way up.

See Also