- Analytics

- Market Overview

Dow and S&P 500 hit historical high - 23.2.2015

Having added on Friday, with FTSEurofirst hitting a record high since 2007, American stocks show pullback. In our opinion, today's turn is driven by weak quarter earnings of the biggest European bank, HSBC, and negative IFO Business Climate data. HSBC shares lost 5%. To be noted, on Friday British FTSE 100 closed at the historical high due to good corporate news by PostNL and Lloyds Banking group. Today no important statistics are expected in Europe. German Q4 final GDP will be released tomorrow morning together with German exports indicator. The forecast is neutral, but if it is not confirmed, markets will react notably.

Nikkei has risen in tandem with other global indices and struck its 15-year high. The yen and the euro slipped against the American dollar. It underpinned top Japanese exporters' shares: Toyota Motor and Nissan Motor added 1% and 1,7% respectively. Important macroeconomic data are to be issued in Japan late on Thursday.

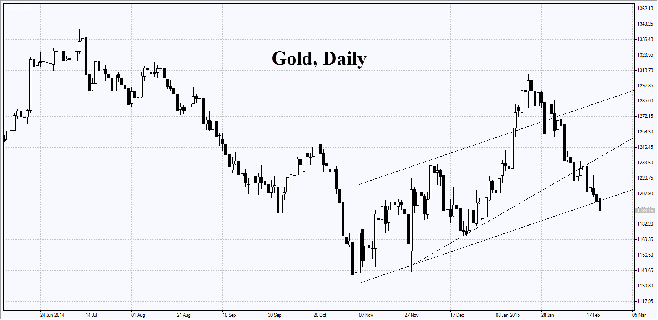

Against the background of stabilizing Greek economy gold slumped to the 7-week minimum below the round figure of $1200 per ounce. Quotes were also affected by Chinese investors celebrating New Year. In previous overviews we mentioned the negative effect of low premium on gold before New year holidays in China, which reduced the demand for the metal. We remind that Chinese stocks are closed on February, 18-24. According to US Commodity Futures Trading Commission, the gold contracts number has dropped for 3 straight weeks and reached the 6-week low. Meanwhile, SPDR Gold Trust reports that late on Friday gold real purchases have advanced for 2 consequent days. Gold reserves attained 771.25 tons and are close to the 5-month high.

Platinum quotes plummeted to the 5-year low. Platinum-to-gold price discount has hit on Friday the maximum since April, 2013, making up $54 per ounce. Market participants believe that economic recession in Europe, caused by Greek bailout, will depress the demand for cars. European motor companies consume around 20% of world platinum. We do not rule out, that for the time being a Personal Composite Instrument (PCI) on these metals may be of use.

Copper quotes also fell, but unlike precious metals, they sustain more or less bullish trend. On Friday the prices were driven up by good American Manufacturing PMI for February. The strike on copper mines in Zambia, owned by Canadian Barrick Gold Corporation, produced additional effect.

See Also