- Analytics

- Market Overview

Positive EUR/USD mid-term forecast - 30.3.2015

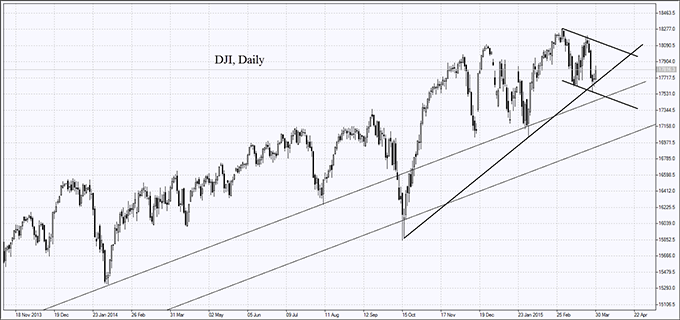

American macroeconomic data were mixed on Friday: Consumer Confidence outstripped forecasts while final GDP was slightly worse-than-expected. The trading volume on American stocks was 16.5% below the monthly average. During the previous week S&P 500, Dow and Nasdaq lost 2.2%, 2.3% and 2.7% respectively. At 14:30 CET Personal spending for February will be announced. At 16:00 Pending Home sales will bee released. The outlook is positive. Futures on American stock indices and European shares are growing as US Dollar index inches higher.

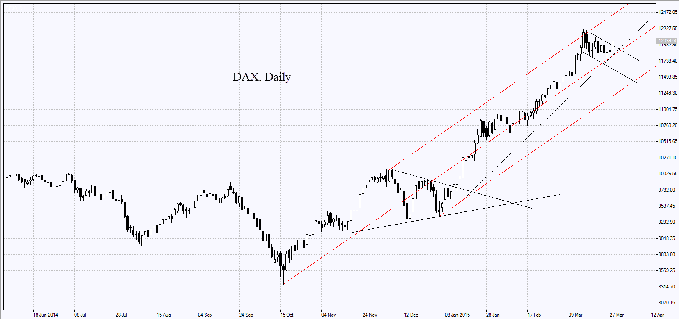

European FTSEuorofirst has added 1.2% today. At 11:00 CET eurozone Consumer Confidence and Business Climate Indicator were released. Technology companies' shares take the lead, following Intel-Altera merger deal information. However, unsettled Greek question produces a negative affect. Greek ATG has lost 1.4% today Most investors believe that Greece will have sufficient money only til April, 20. The country will have to find the solution to its financial problems up to this moment. Today at 14:00 CET Inflation for March will be announced in Germany. According to our forecast, the deflation risk will be reduced and the data will appear to be positive. European market may show a record growth since 2009.

Nikkei has expanded today together with other stock indices, despite negative Industrial Production in February. Last week Nikkei index declined for the first time, following 10 straight weeks of surge. As we mentioned in our previous overviews, State Pension Fund and private investors allocated their investment in domestic stocks and reduced the share in government bonds. This sounds logical to us, if to take into consideration the continuing monetary stimulus and low bond yields. Tomorrow at 7:00 CET Housing Starts and Construction orders will be released in Japan.

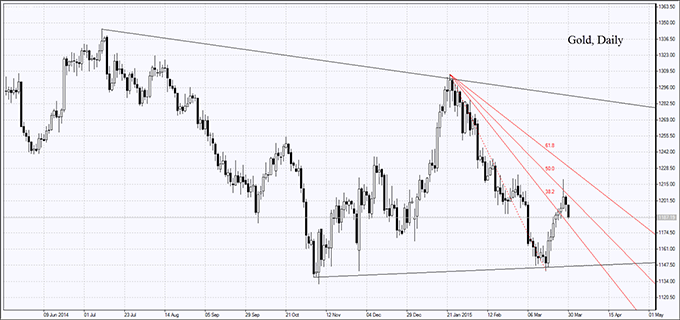

Despite the postponed rate hike, gold quotes have been retreating two consequent days. FRS explains the decision by stating that macroeconomic statistics became better. It is probable that economic recovery together with the inching dollar resulted in gold prices pulling back. Stabilizing political situation in Yemen has put additional pressure on gold. To be noted, mixed sentiment on gold market has increased the number of forward trades to its high since 1999. They are opened by gold-mining companies that are concerned with the probable decrease in prices. In our opinion, that may drive up gold quotes in the future.

Oil prices have dropped today on the back of negotiations on Iranian nuclear programme. That may boost Iranian oil exports. It is worth mentioning that Libya also reported it would raise the supply.

See Also