- Analytics

- Market Overview

Markets rise as oil surges - 16.4.2015

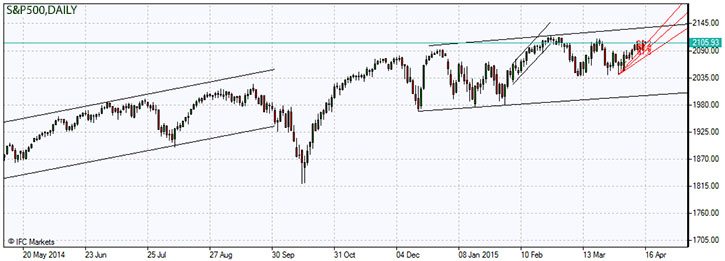

US stocks rose on Wednesday as bullish sentiment was bolstered by better than expected earnings and rising oil prices. The S&P 500 advanced 0.5% and closed just below the record level reached in March. Of 37 companies that have reported earnings 35 have either beat or met lowered estimates for the first quarter. Today Citigroup, Goldman Sachs and United Health Group will report first quarter earnings. Investors discounted disappointing manufacturing data. The Empire State manufacturing index plunged to negative territory, and industrial production fell 0.6% in March, the largest drop since August 2012. The weak data indicate the economic activity didn’t accelerate after winter. The National Association of Home Builders housing market index, a gauge of confidence among home builders, rose in April. The dollar retreated against major currencies as data once again indicated a slowdown in growth in the first quarter. The ICE US Dollar Index fell 0.4% to 98.31. Today at 13:30 CET March Housing Starts and Building Permits, as well as Initial Jobless Claims will be released in US. The tentative outlook is positive for the dollar. At 15:00 CET Philadelphia Fed Manufacturing Index for April will be published. The tentative outlook is positive. Today at 18:00 CET, 18:10 CET, 18:30 CET and 20:00 CET Fed’s Lockhart, Loretta Mester, Eric Rosengren and Fischer will speak on economic outlook in Florida, New York, London and Washington respectively.

European stocks rallied after the European Central Bank said it was committed to the full-scale 1.1 trillion euro bond-buying program. The Stoxx Europe 600 climbed 0.6% and finished at 414.06, above the record close of 413.63 reached on Monday. The massive money-printing of the ECB has lowered the government bond yields and weakened the euro, with the tide of newly created liquidity fueling a sharp rally in equities while exporter earnings get boosted by weaker euro. The Athex Composite fell 1.9% on worries about Greece’s cash crunch. The ECB on Tuesday raised the amount of money Greek banks can borrow under an emergency-lending program to 74 billion euros from 73.2 billion euros the previous week. The ECB left unchanged the interest rates. No important economic data are expected today in euro-zone.

The Nikkei edged up 0.1% today as rising oil prices lifted oil and mining shares, which offset profit-taking in recent outperformers like food companies and drugmakers. Sharp surged 4.5% as company was reported to meet today with its banks to discuss a $1.7 billion rescue plan. Tomorrow at 06:00 CET March Consumer Confidence Index will be released in Japan. The tentative outlook is positive for yen.

Oil prices surged on Wednesday as US crude oil inventory recorded lower-than-expected weekly build-up and the International Energy Agency raised global demand forecast. West Texas Intermediate jumped 6% , with the May Brent and WTI spread narrowing to $3.93. The IEA revised upward global oil demand for 2015 by 90,000 barrels a day to 93.6 million barrels a day. The demand increase is clearly bullish for oil, nevertheless EIA analysts are pointing to similarly-sized increase in global supplies, which should leave the market balance unchanged.

May natural gas gained 3.2% Wednesday, ahead of the weekly US government report on supplies today at 15:30 CET.

Gold prices finished higher on Wednesday as disappointing economic reports weakened the dollar and pushed out the timeline for when the Fed will raise the interest rates.

See Also