- Analytics

- Market Overview

Greek referendum - 6.7.2015

After opening with a negative gap European stocks have been advancing together with the euro. Investors are unwilling about selling the euro ahead of the European Union's reaction to the probable Grexit. Today European Central Bank official will organize a meeting, a summit of European leaders will take place tomorrow. Greek finance minister Yanis Varoufakis resigned today, producing additional support to the euro. Despite the referendum, which virtually means that Greeks refused to pay off debts, investors assume that an agreement under new conditions may be reached and see 50% chance of Grexit. The Swiss franc did not show a considerable growth. Market participants are concerned about the intervention by Swiss National bank. Its representatives said that they were not going to allow the Swiss franc dropping. Financial stocks were leading in losses because of the Greek crisis: Unicredit and IIntesa Sanpaolo fell 3%, Societe Generale and Deutsche Bank retreated 2.5%. Rolls-Royce cut the financial forecasts so its shares slumped 9%. This morning there was released a number of strong economic indicators in eurozone. Factory orders in Germany turned out to be positive.

After opening with a deep negative gap Nikkei have been rising in the course of the day. Mitsubishi UFJ Financial Group and Mizuho Financial Group demonstrated the biggest drop – they contracted 3%. The yen climbed after the referendum. Investors hope that the European Union problems will not affect Japan much. Trade Balance and other macroeconomic indicators will be published in the country next morning.

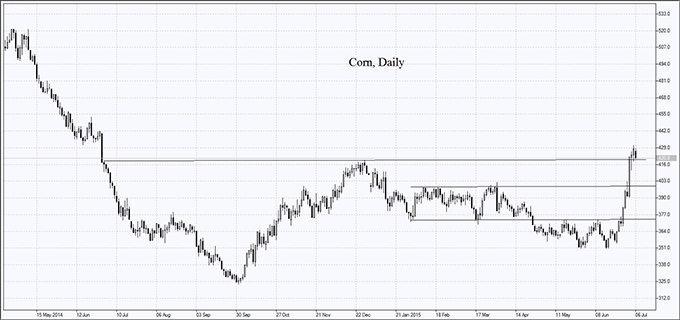

Grain quotes have been falling due to rising economic risks and good weather in the US. To be noted, Informa Economics agency cut the corn crops forecast from 13.564bln bushels to 13.412bln. The average crop yield was lowered to 165.4 bushels per acre. This may underpin corn prices. Oil quotes fell after the Greek referendum as well. China National Offshore Oil Corporation reported that oil production in China may increase 1.6%, beating the last-year high. The information produced additional pressure on oil prices. China is the fourth largest oil producing country. In 2014 China extracted 4.2mln barrels daily. In 2015 it produced 4.25mln barrels, which is 1.8% more. Investors suppose that the growing production in China, Russia and OPEC countries may create the surplus of 2.5mln barrels per day. Saudi Arabia, represented by Aramco state company, lowered Arab Light oil prices for South East buyers.

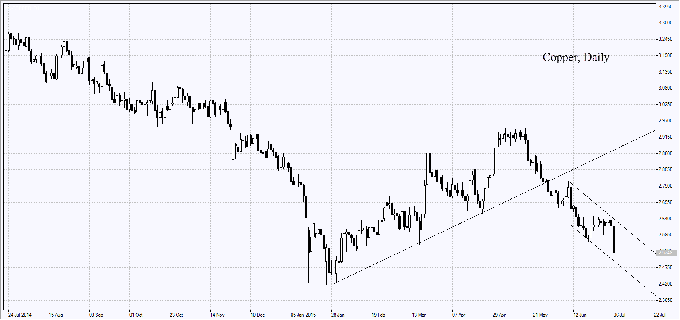

Since the chances of Grexit are now 50% gold has not yet been considered as a safe-haven asset. Its quotes slipped despite the strong opening. They were driven down by the expensive dollar as well. Copper prices lost almost 4% at Chinese Stock Exchange, recording the highest 5-month drop. Taking into consideration the 30% plunge of Chinese stocks, market participants expect economic slowdown and falling copper demand.

See Also