- Analytics

- Market Overview

FRS meeting may affect the dollar - 27.7.2015

Global stock indices retreated on Friday. We assume they were driven down by negative macroeconomic data from the USA and the EU. New Home sales slumped 6.8% in June to their 7-month lowest. Industrial PMI in the EU, Germany and France turned out to be worse-than-expected. Besides, the Biogen corporation cut the current year earnings forecast, putting additional weight on stocks. As a result, S&P 500 showed a weekly decrease of 2.2%. Dow Jones contracted 2.9%, while Nasdaq lost 2.3%. The Friday statistics in the USA appeared to be less bright than in Europe, so US ICE Dollar Index dropped in relation to the euro. The American stocks trade volume was 11% above the monthly average, making 7.3bln shares. Durable Goods Orders in June will be released today at 14:30 CET; the tentative outlook is positive.

European indices have been edging higher at the moment, but have been closing with a minus for 5 consequent days. Ifo Climate Business survey in July outstripped forecasts, underpinning the euro. Analysts suppose that Greek stocks will resume business this week. Some market participants worry that they may open with a negative gap, restraining other European stocks. No important macroeconomic news is published today in the EU.

Nikkei fell to the 2-week lowest today, following other world indices, as Chinese shares plummeted after negative national earnings reports (data for June). Investors anticipate that economic slowdown in China may cut down the demand for Japanese export.

Shanghai SE Composite Index plunged 8.5% this morning. Traders sentiment deteriorated on expectations of economic slowdown in China, which produced pressure on many commodity futures.

Oil futures have been declining on expectations of the growing production in Iran. To be noted, Iraq has already increased export to 3mln barrels daily and became the second largest exporter in OPEC after Saudi Arabia. Despite the drop in prices, the number of rigs in the US rose by 21, the fastest pace since April, 2014 (the data were announced by Baker Huges). The USA have been producing about 9.7mln barrels per day for a long time. Most investors estimate that global oil prices will not exceed $70 per barrel till 2017. According to US Commodity Futures Trading Commission (CFTC), the net long oil futures position has been contracting at the fastest speed since 2006 for the last 4 weeks. At the same time the overall number of net long positions has been the lowest for 5 years. China is one of the chief beneficiaries of the current oil market situation. According to National Energy Administration, the power consumption in China increased 0.7% in the first half of the year. Meanwhile, the consumption of non-ecological coal contracted 5.8% due to the usage of more clean oil (+2.1%) and natural gas (+4.3%).

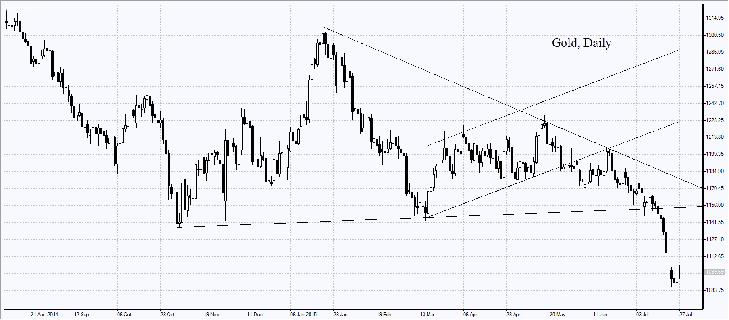

According to CFTS, the aggregate gold net short position has shaped at Comex for the first time since 2006. The similar copper and silver positions were previously opened by the largest hedge funds. Gold futures have now been rebounding. The price used to drop for 5 straight weeks for the first time since 2012. We believe that market participants will be looking forward to the FRS meeting minutes that are expected on Wednesday. The rate hike data may affect the American currency and precious metals prices.

See Also