- Analytics

- Market Overview

Dollar strengthens on Fed rate hike expectations - 31.7.2015

American indices were almost unchanged on Thursday. Macroeconomic data were mostly positive though slightly weaker than might be. The second quarter GDP increased 2.3% – a little bit below estimated 2.5%. The American economy advanced 1.5% in the first quarter as compared to 1.9% the previous year. The second-quarter surge was mainly driven by rising due to cheap petroleum consumer spending. Personal Expenditure Index (PCE) in the first half of the year advanced 2.2% – the sharpest growth since early 2012. Taking into account yesterday macroeconomic news, investors considered Fed rate hike to be more likely. This factor underpinned US ICE Dollar Index. Procter & Gamble, Facebook and Whole Foods Market presented worse-than-expected quarterly reports. Their shares lost 4%,1.8% and 11.6% respectively. These data impaired positive statistics. As a result, American stocks did not demonstrate a strong movement. To be noted, the reporting season is close to an end. More than 64% of S&P 500 companies have already reported earnings. The American stocks turnover was 5% below the monthly average, making 6.4bln shares. Today at 15:45 CET Chicago Purchasing Manager Index for July will be released in the US. At 16:00 CET University of Michigan will publish Consumer Confidence Index.

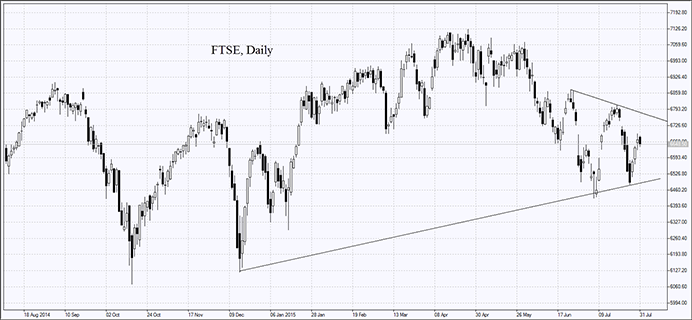

European stocks have been rising for 4 consequent days due to good corporate reports. The Belgian UCB pharma company raised the annual earnings forecast with its shares adding 5.2%. BNP Paribas and Natixis banks and Airbus reported positive earnings; BNP shares added 3.5%. Investors expect the overall companies income to rise 5.7%. Consumer Price and Unemployment indices were announced today in eurozone. We assume that they appeared to be slightly negative. No important macroeconomic data are published in the EU this Friday.

Nikkei edged higher today due to good labor market and July inflation statistics. Consumer prices grew more-than-expected, reducing deflation risks.

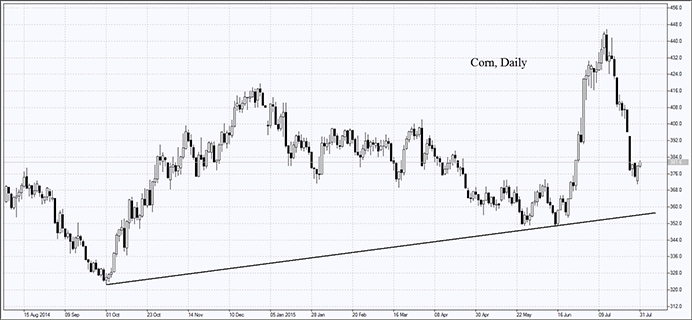

Grain futures have been climbing on expectations of drought in Europe, Canada and Argentina. Grain prices in July were totally determined by weather conditions. Since they were very good in the US, wheat futures may show the sharpest monthly fall for 4 years. It is worth mentioning that International Grains Council increased the global corn production forecast to 966mln tons in the season 2015/2016 (due to the probably increasing crops in China) and cut the wheat production forecast to 710mln tons because of Canada.

Oil prices retreated after the meeting between Russia and OPEC members. During the conversation OPEC representatives stated they were not going to reduce the production. RF Ministry of Energy Head Alexander Novak estimates the oil demand to fall 1.2-1.3mln barrels this year. He believes that oil prices will be moving around $50-65 per barrel.

Gold futures have been dropping for 6 straight weeks – the longest continuous fall for 16 years. In June they lost 7.4%, recording the worst monthly result for 2 years. The probable Fed rate hike is the main reason for the downtrend. In theory, it makes dollar assets more attractive. We would like to point out low demand for gold in China: at Shanghai Exchange gold is traded only $1 above London. Taking into account the steep fall in gold prices, we do not rule out a rebound after Non-Farm Payrolls release, expected August, 7.

See Also