- Analytics

- Market Overview

Dollar dropped on concerns about China - 21.8.2015

Yesterday American stocks edged lower after 2 days of loss on concerns that Chinese economy slowdown may result in a global crisis. Caixin China PMI industrial index dropped 0.7 points in August to 47.1. This was the steepest monthly fall for 6.5 years. To be noted, it has been moving below 50 for 6 months. This mark is considered to be a separation point between industrial expansion and contraction. S&P 500 retreated to a 6-month low and showed the sharpest daily drop since February. 2014. Disney and Time Warner media stocks lost 6% and 5% respectively as the Bernstine investment company cut their ratings. Apple shares declined 2% because of sales in China dropping for the first time in the second quarter. The American stocks trade volume on Thursday was 18% above the monthly average, making 7.9bln shares. Today at 15:45 CET the Markit agency will release Preliminary Manufacturing PMI (Purchasing Managers Index).

European indices recorded new lows this morning because of negative statistics from China. Now they have been slightly rebounding due to good Manufacturing PMI in Germany and eurozone (August data). Today at 16:00 CET Consumer Confidence index in August will be published in the European Union; the tentative outlook is neutral.

The euro fell to its 2-month lowest against the dollar: investors expect that eurozone economy will grow while China will slow down. US ICE Dollar index recorded a new 8-week minimum. According to market participants, Chinese recession makes Fed hike in September less likely.

Nikkei dropped for 5 consequent days to a six-week low. However, the contraction was not that intense as compared to other global indices. On Wednesday and Thursday Bank of Japan injected liquidity to financial markets, each day buying exchange-traded funds worth 33.7bln. It is worth mentioning that stocks retreated regardless of good macroeconomic data, released this morning. Japanese Manufacturing PMI advanced in August from 51.2 to 51.9. More of that, super market sales increased in July. The yen inched higher third day in a row. It has been used for carry trade operations.

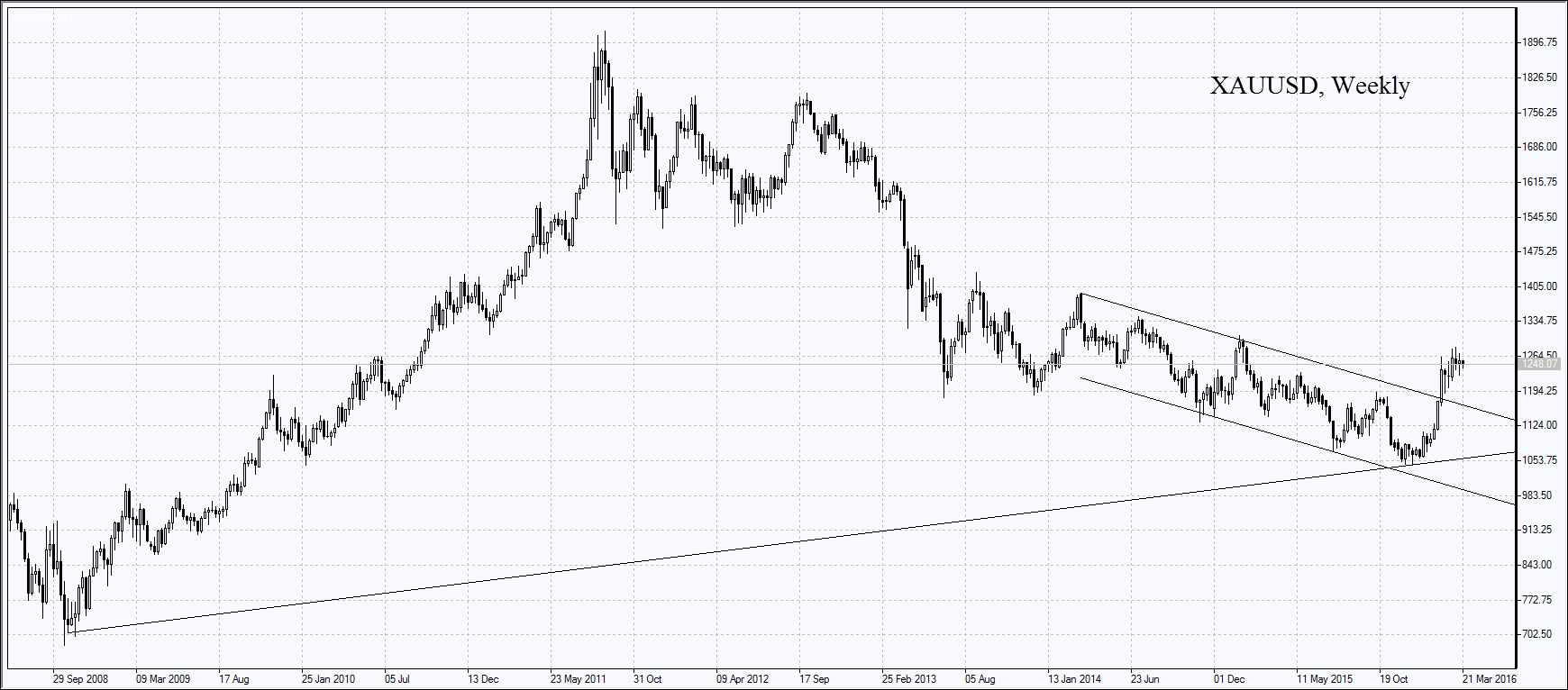

Demand for gold increased due to concerns about world economic growth prospects in the light of Chinese recession. Gold prices reached a new 6-week high. The weekly record may be the best since January. Greek prime minister Alexis Tsipras resigned from office. The country may hold new parliamentary elections September, 20, which may negatively affect European markets. We would like to remind you that gold futures marked a 5.5-year low this July.

Oil prices have been declining for 8 straight weeks. This is the longest constant fall since 1986. To be noted, 29 years ago they plummeted from $30 to $10 per barrel. The USSR launched a reformation program called “Perestroika”, which led to its collapse in the end. Then oil had been traded for almost 10 years between $15 and $22 per barrel. It skyrocketed to $40 October, 1990, when the US invaded Kuwait. After the crisis of 1998 in Russia oil prices set a steady uptrend.

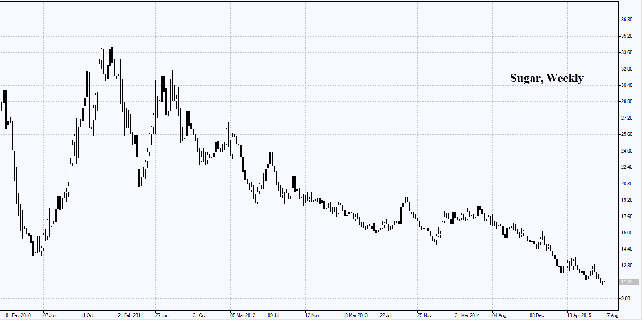

In July China increased sugar import 72.7% to 485 thousand tons as compared to July, 2014. In theory, it may drive the prices up from their recently recorded 7-year low. If compared to this June, sugar import by China doubled.

See Also