- Analytics

- Market Overview

US stocks retreat while Trump’s trade adviser calls euro undervalued - 1.2.2017

Nasdaq outperforms broad market index

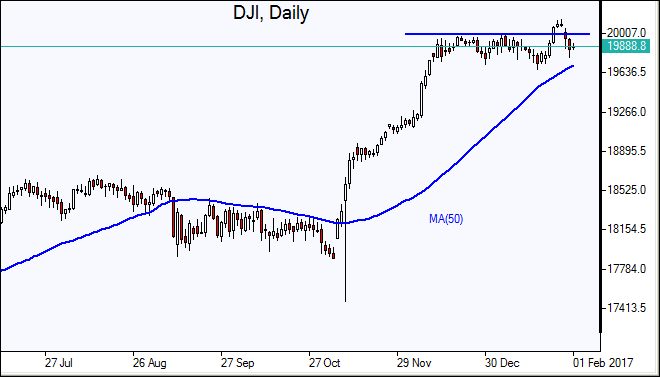

US stocks ended lower pairing earlier losses on Tuesday as weak economic data failed to boost subdued market sentiment after President Trump’s controversial ban on immigration from seven predominantly Muslim countries. The dollar retreated further after Peter Navarro, the head of recently formed National Trade Council, called Europe’s shared currency “grossly undervalued.” The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.8% lower at 99.559. Dow Jones industrial average fell 0.5% to 19864.09 led Goldman Sachs and JP Morgan shares, down 2% and 1.6% respectively. For the month, the blue chip index gained 0.5%.The S&P 500 closed 0.1% lower settling at 2278.87 with industrials, technology and financials sectors leading the decline. The broad market index gained 1.8% over the month. The The Nasdaq index outperformed, closing 1.07 points higher at 5614, gaining 4.3% over the month, the biggest monthly rise in seven months.

Today the Federal Reserve will announce its interest rate decision after conclusion of its two-day policy meeting. The central bank is widely expected to keep policy on hold and investors will focus on the balance of risks statement to judge when policy makers are likely to raise the rates this year. Three rate hikes are expected in 2017. In economic news the January consumer confidence by Conference Board came in weaker than expected at 111.8, lower than the December reading of 113.3. Today at 13:00 CET Mortgage applications will be released by the Mortgage Bankers’ Association in US. At 16:00 CET January ISM Manufacturing PMI will come out, the outlook is positive for dollar. And at 20:00 CET Federal Reserve interest rate decision will be released, no change in policy is expected.

European stocks slip on strong euro

European stocks extended losses on Tuesday as euro gained after President Trump’s trade adviser Peter Navarro criticized the shared currency as undervalued, saying euro’s low valuation gave Germany an advantage over its trading partners. Both euro and British Pound strengthened against the dollar. The Stoxx Europe 600 lost 0.7%. Germany’s DAX 30 underperformed falling 1.3% to 11535.31. France’s CAC 40 lost 0.8% and UK’s FTSE 100 index slipped 0.3% to 7099.15.

European stocks fell as exporters’ prospects deteriorated with stronger euro making European products more expensive to buy for holders of other currencies. Market indices fell despite data showed euro-zone economy expanded by 1.8% compared with the fourth quarter of 2015, more rapidly than the U.S. economy did in 2016 as a whole. Today at 10:30 CET UK January Manufacturing PMI will be released by Markit. The tentative outlook is negative for Pound.

Asian markets recover

Asian stocks are up today with investors positioning ahead of Federal Reserve’s interest decision. Nikkei ended 0.6% higher at 19148.08 as the yen weakened against the dollar, recovering some losses after President Trump’s comment the previous day that “every other country lives on devaluation”. Australia’s All Ordinaries Index is up 0.5% with the Australian dollar edging higher against the dollar. Markets in mainland China are closed for the Lunar New Year holiday while reports showed manufacturing and services activity continued to expand in January.

Oil prices steady

Oil futures prices are edging higher today after reports Russia cut its oil and gas condensate production by around 100,000 barrels per day (bpd) between December and January, down to 11.11 million bpd. March Brent crude closed 0.9% higher at $55.70 a barrel, but registered a nearly 2% decline for the January. The American Petroleum Institute reported yesterday US crude stocks rose by 5.8 million barrels last week to 488 million barrels. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also