- Analytics

- Market Sentiment

USD Net Longs Rise to Highest Level in Five Weeks

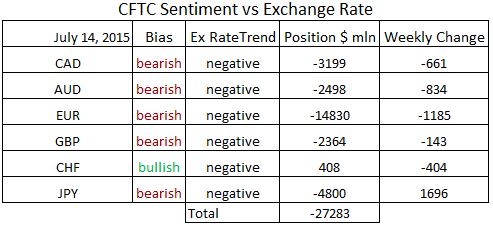

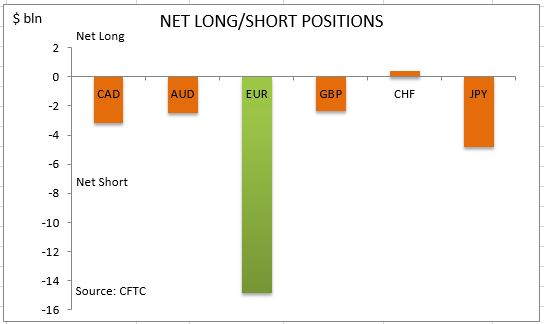

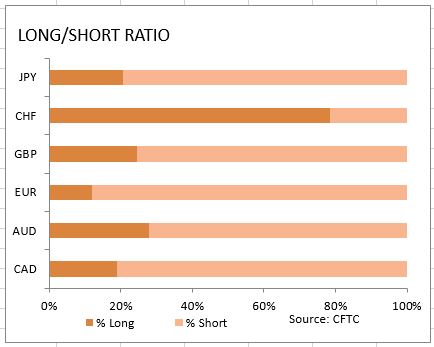

The report of the Commodity Futures Trading Commission (CFTC) covering data up to July 14 showed the value of US dollar net long position increased to $27.28 billion from $25.75 billion in the previous week, hitting the highest level in past five weeks. The economic reports during the week like rising jobless claims indicated sluggish growth of US economy. At the same time Federal Reserve Chair Janet Yellen confirmed in her speech on July 10 in Cleveland that the Fed will hike the interest rates later this year as US economy recovers, inflation moves toward the longer-run objective of 2 percent and the labor market moves closer to maximum employment. The speech provided a lift to US dollar in addition to rising safe haven demand for the dollar as Greek debt crisis unfolded. As is evident from the Sentiment table, the sentiment deteriorated for all major currencies except for the Japanese yen. All currencies are still held net short, with the Swiss franc remaining the only major currency held net long against US dollar.

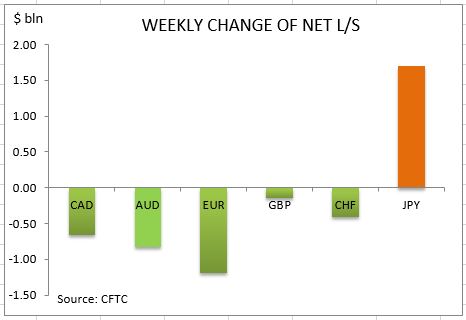

The euro sentiment deteriorated again following the first improvement in a month the previous week. The net short bets in euro widened $1.18bn to $14.8bn, with euro comprising 54% of long US dollar position. The euro net short position rose as investors cut gross longs and increased gross shorts.

The improvement in Japanese yen sentiment continued at the same pace with net short position narrowing $1.69bn to $4.8bn as investors covered shorts and increased gross longs. The Japanese yen still has the second highest short bets against US dollar, making about 17% of aggregate US dollar long position. The British pound net short bets widened $0.1bn to $2.3bn with investors cutting both gross longs and gross shorts.

The sentiment toward the Canadian dollar deteriorated further with net short position widening $0.66bn to $3.2bn. Investors increased both gross longs and gross short positions. The Australian dollar net short bets widened by $0.8bn to $2.4bn as investors cut gross longs and increased gross shorts. The Swiss franc net longs decreased by $0.4 to $0.4bn as investors cut gross longs and increased gross shorts.

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Last Sentiments

- 18Mar2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies...

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies...