- Education

- Forex Technical Analysis

- Chart Patterns

- Continuation Patterns

- Forex Flag

Flag Chart Pattern: Forex Chart Pattern

Flag Chart Pattern

Formation

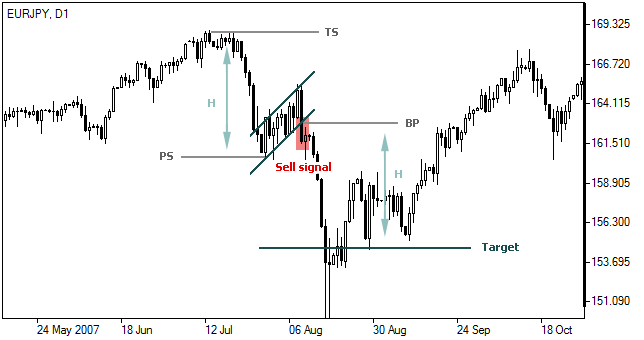

This pattern is represented by two parallel trendlines, a support and resistance, holding the range between high and low prices within, visually forming a parallelogram or a flag and generally directed against the main trend. The pattern is often characterized by a sharp price entering after intensive movement.

Interpretation of Forex Flag

This pattern confirms the trend movement direction in case of breaking through:

- a sell signal arise if the pattern is formed in a downtrend and the price falls below the support line (plus certain deviation is possible);

- a buy signal arise if the pattern is formed in an uptrend and the price rises above the resistance line (plus certain deviation is possible).

Target price

Following a flag pattern formation the price is generally believed to change in the same direction it was going prior to the pattern by at least the same amount as the price change from the start of the trend to the formation of the flag. The target level is calculated as follows:

In case of a downtrend: T = BP – (TS – PS) In case of an uptrend: T = BP + (PS – TS) Where:T – target price;

BP – breakthrough point;

TS – trend start point;

PS – pattern start point.

How to use Forex Flag on NetTradeX trading platform

Not sure about your Forex skills level?

Take a Test and We Will Help You With The Rest

How to use Forex Flag in trading platform

You can see the graphical object on the price chart by downloading one of the trading terminals offered by IFC Markets.

Was this article helpful?

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center