- Analytics

- Technical Analysis

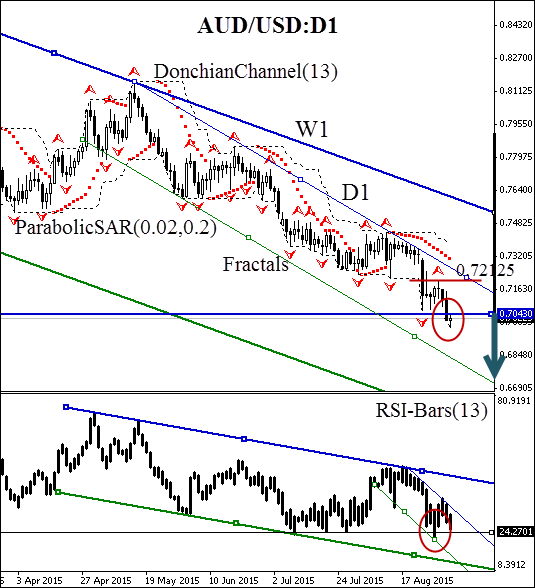

AUD USD Technical Analysis - AUD USD Trading: 2015-09-02

Sell AUD or not? Waiting for trade balance

The Australian Dollar continues falling despite the temporary growth of the gold. Partly it happens due to the strengthening of the US currency and the economic uncertainty. Today the Australian trade balance of the previous month is to be published. The tentative outlook is negative. If the analysts prove to be right, the market will show the growth of the short positions which serves the perfect opportunity of joining the trend. .

At this moment we see the persisting bearish trend on the weekly and monthly timeframes. The slumped US indices made Dollar strengthen against the other currencies. The matter is whether this temporary trend is strong enough to support the bears. In our opinion, the Australian Dollar will help make money from the short positions in case of the trade balance growth. At this moment, the price has broken through the weekly support of 0.70430. The RSI-Bars oscillator which surpassed the 24% support level and the Parabolic Indicator reversal confirm the signal. The Donchian channel adds to the bearish sentiment as well.

We suggest opening the market sell order after RSI breaks through the 24% level for the second time. The risks are to be limited at the level of the Bill Williams’s fractal last high of 0.72125. This level served the support line of the Bollinger channel till the strengthening of the bearish trend. We recommend moving the stop every day to the next maximum following the Parabolic signal. By doing this, we alter the profit/loss ratio into our favour. Despite the high probability of the above scenario, the Aussie may lose the downside momentum. The risks are due to the forthcoming Jobless Claims in the US. Nevertheless we assume the oscillator signal works only subject to the long-term fundamental trend.

| Position | Sell |

| Sell | at market |

| Stop loss | above 0.72125 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.