- Analytics

- Technical Analysis

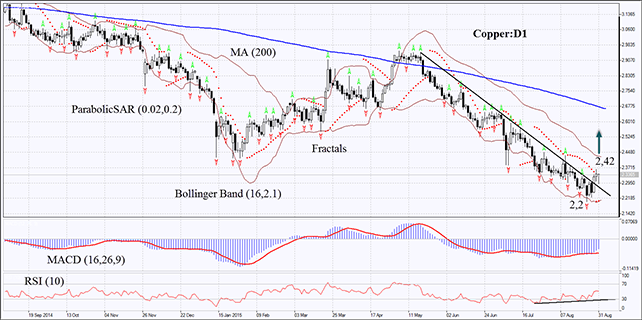

COPPER Technical Analysis - COPPER Trading: 2015-08-31

The industrial indicators are to be released in China

The copper quotations on the daily timeframe are struggling for growth after hitting a 6-year low on Monday. In our opinion, no particularly positive news has been announced yet. The market participants may reckon on the fact that the softer monetary policy by the People’s Bank of China will support economic and industrial growth in this country. Let us remind you that it has already reduced the rate four times this year. Tomorrow morning at 3:00 and 3:45 CET several Manufacturing PMIs will be released. We admit the possibility of the further copper price growth subject to the positive statistics from China.

On the daily chart the Copper:D1 has rebounded from the 6-year low breaking up the support line of the downward trend and the last upper fractal. The Bollinger Bands have slightly contracted which indicated the lower volatility. The RSI has formed the bullish divergence leaving the “oversold” zone and exceeding the level of 50. MACD and Parabolic Indicators have formed the buy signal. We do not rule out the possibility of the bullish trend in case the copper breaks above 2.42 which is the second upper fractal and the Bollinger band. The preliminary risk fixation is possible below the 6-year low of 2.2 which is the lower fractal as well, the Bollinger band and the Parabolic signal. Having opened the delayed order we recommend to move the stop to the next fractal minimum following the Bollinger and Parabolic signals every 4 hours. By doing this, we alter the possible profit/loss ratio in our favour. The most risk-averse investors may switch after cutting a deal to the 4-hour chart and fix there stop-loss moving it in accordance with the trade dynamics. If the price meets the stop loss level without reaching the order, we recommend cancelling the position as the market is subject to the unforeseen endogenous changes.

| Position | Buy |

| Buy stop | above 2,42 |

| Stop loss | below 2,2 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.