- Analytics

- Technical Analysis

EUR CHF Technical Analysis - EUR CHF Trading: 2015-07-21

Will market respond to reduced Grexit risks?

Today we consider the EUR/CHF currency pair on the daily chart. As Greece ramped up the €86bln bailout the risks of the Greek default and withdrawal from the EU decreased. The austerity measures were adopted by the Greek parliament while Syriza Parliament group, which had initiated the default, shrank to 123 people. Ten ministers that did not agree to the conditions, proposed by European creditors, were removed from office. Meanwhile, the Swiss franc is still traded within a narrow range in relation to the euro. In other words, the euro does not lose to the franc despite reduced Greek default risks.

We would also like to draw your attention to the Big Mac index released by The Economist this year. According to the index, the franc is overvalued to the euro by 60%. In Switzerland a Big Mac costs ₣6.5 or €6.2, while its average cost in eurozone is €3.7. According to the magazine, the franc is overvalued to the euro more than any other national currency. The Norwegian krone is ranked second, overvalued by 40%. A Big Mac costs €5.16 in Norway. Allowing this, the dollar is overvalued to the euro by 18%, while the Russian ruble is undervalued by 53%. In Russia a big Mac costs only €1.72. Given this, the euro is supposed to cost 30 rubles. No doubt that we should not attach particular importance to this indicator. The Venezuelan bolivar and the Ukrainian hryvnia take the lead by undervaluation - 83.5% and 61.8% respectively. A Big Mac costs €0.61 in Venezuela and €1.41 in Ukraine. Yet, it is time to lay aside the Bic Mac index and go back to technical analysis.

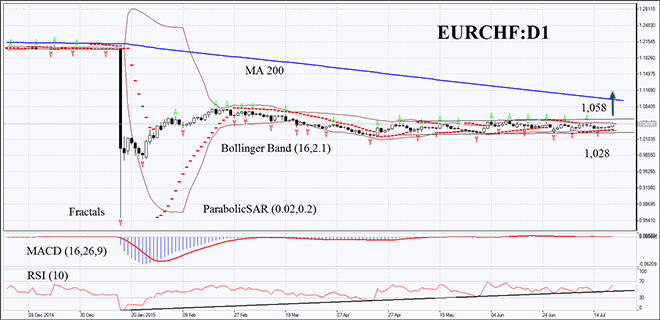

On the daily time frame the EUR/CHF currency pair has been traded in a narrow range below the 200-day Moving Average. Bollinger Bands closely approached each other. MACD bars did not advance much, indicating low volatility. Parabolic has been giving buy signals. The growing RSI-Bars indicator has shaped a bearish trend but has not yet reached the oversold zone. The bearish momentum may develop if another EUR/CHF bar closes above the range upper boundary at 1.058. A stop loss may be placed under the range lower boundary at 1.028. After pending order activation the stop loss is supposed to be moved every four hours to the next fractal low, following Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most cautious traders are recommended to switch to the H4 time frame and place a stop loss there, moving it after the trend. If the price reaches the stop loss without triggering the order, we recommend to cancel the position: the market sustains internal changes that were not considered.

| Position | Buy |

| Buy stop | above 1.058 |

| Stop loss | below 1.028 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.