- Analytics

- Technical Analysis

Natural Gas Prices Technical Analysis - Natural Gas Prices Trading: 2016-11-16

Weather weighs on gas prices

US Natural gas started advancing after the release of cold weather forecasts for this winter as it is used for heating purposes. At the same time, national production is at 3 year low. Will Natgas continue advancing?

Markets believe the gas consumption to rise this week to 76.8bn cubic feet a day from 73bn a week earlier. Next week the production is expected to reach 85.3bn cubic feet a day. Gas production in US was on average just 70.2bn cubic feet a day in recent 30 days which is the lowest since 2013. Active gas rig count fell by 2 units to 155 in US in a week, according to Baker Hughes. The count of shale rigs also fell 2 to 457 units. The 7 major shale fields account for 60% of dry gas production in US. 75bn cubic feet of gas per day was consumed in US in 2015. This year the consumption is to reach 75.7bn cubic feet a day. At the same time, the national production is to fall in 2016 in 72.3bn cubic feet a day from 74.1bn in 2015. Given such a divergence, US natural gas prices rose almost twofold since March to October this year. The downtrend correction began in mid-October as national stockpiles reached the historical high of 4,017trn cubic feet on warm weather and lower demand. As we see, US natural gas prices depend a lot on weather conditions.

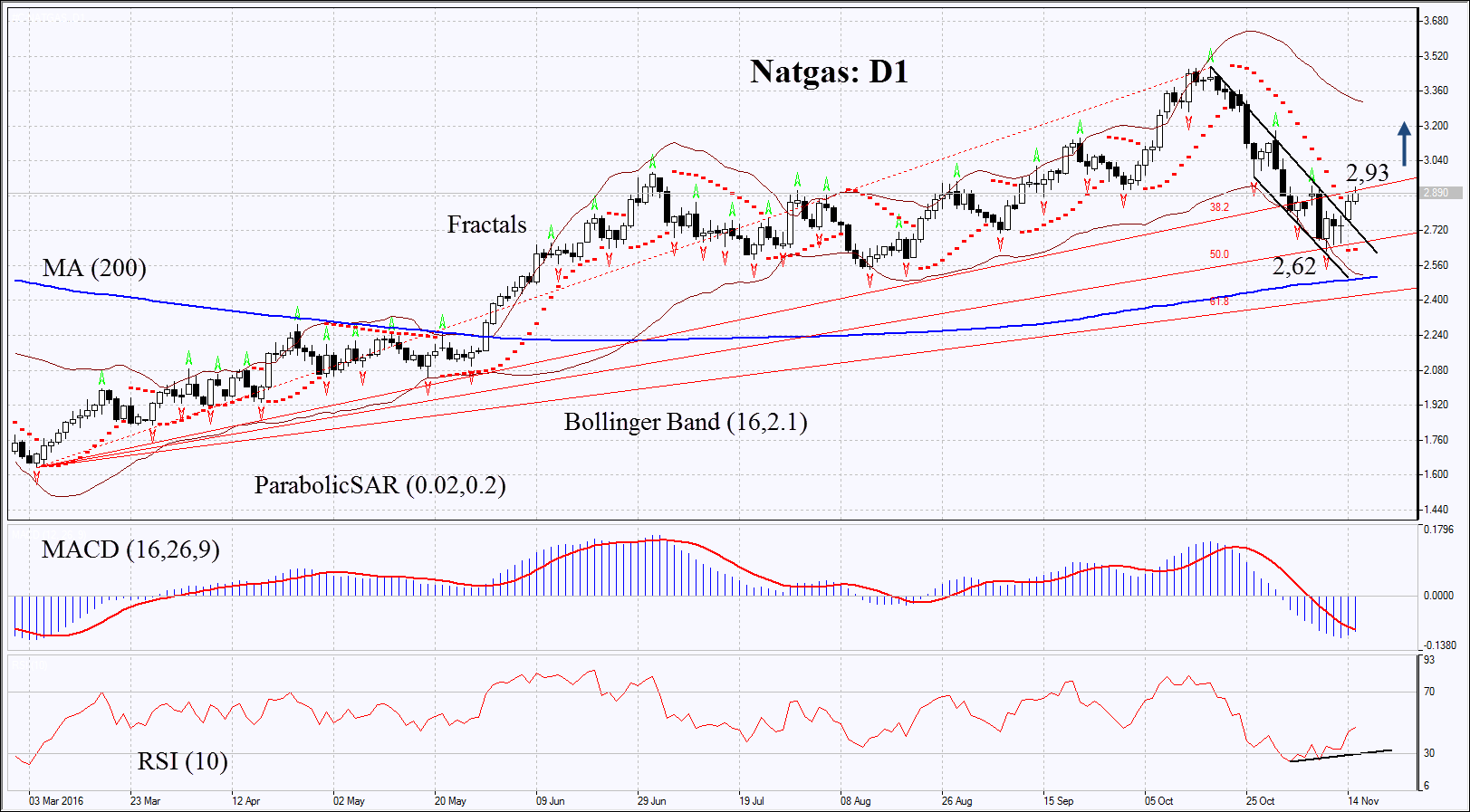

On the daily chart Natgas: D1 is struggling for growth after downward correction. Further increase is possible in case of colder weather or lower natural gas production in US.

- Parabolic gives bullish signals.

- Bollinger bands have widened, which means higher volatility.

- RSI is below 50. It has formed positive divergence.

- MACD gives bearish signals. It has not reversed up.

The bullish momentum may develop in case US natural gas surpasses the last fractal high at 2.93. This level may serve the point of entry. The initial stop-loss may be placed below the last fractal low, Parabolic signal and the Gann line at 2.62. Having opened the pending order we shall move the stop to the next fractal low following the Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop-loss level at 2.62 without reaching the order at 2.93, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis

| Position | Buy |

| Buy stop | above 2.93 |

| Stop loss | below 2.62 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.