- Analytics

- Technical Analysis

USD JPY Technical Analysis - USD JPY Trading: 2015-03-05

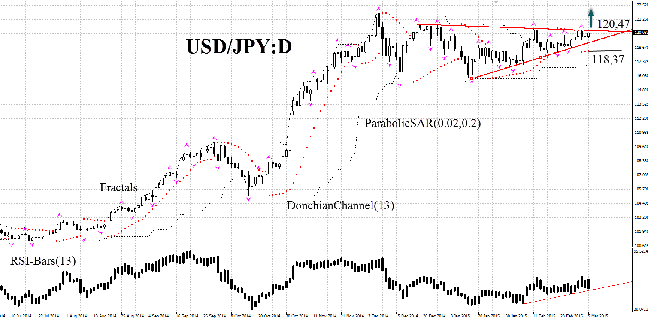

Getting ready to triangle escape

Let us consider again the USD/JPY currency pair daily chart. Triangle shaping or consolidation has been continuing for 3 months. We do not exclude surge if the resistance line is breached. To be noted, during consolidation the US Dollar index added almost 8%. It happened mainly because of the weakening euro, but we do not rule out that other currencies, including the yen, may produce additional effect. In our opinion, the yen was sustained with fairly successful “Abenomics” confirmed with good macroeconomic data. More than that, money base in Japan expanded slower in February (37% YoY against 48% in the previous year. But now, according to our analysts, the yen may be depressed by boosting investment activity. Last week Japanese investment in foreign stocks has risen to its strongest since 2005 (624.5 bln yen). This week Bank of Japan bought ETFs amounting to 70.4 bln yen.

The USD/JPY daily chart is engaged in triangle-shape consolidation. At that, the ascending price corridor is sustained. RSI-Bars has a “bullish” momentum with its bars above 50. We do not exclude the momentum to continue when the fractal high and the Donchian Channel upper boundary (120.47) are breached. A buy pending order may be placed at this level. Stop loss is to be placed at the last Parabolic point, which can now act as the support line at 118.37. After pending order placing, Stop loss is to be moved every four hours near the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes which were not considered.

| Position | Buy |

| Buy stop | above 120,47 |

| Stop loss | below 118,37 |

Dear tarders! The detailed strategy report, based on previous technical analyses, may be found here.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.