- Analytics

- Technical Analysis

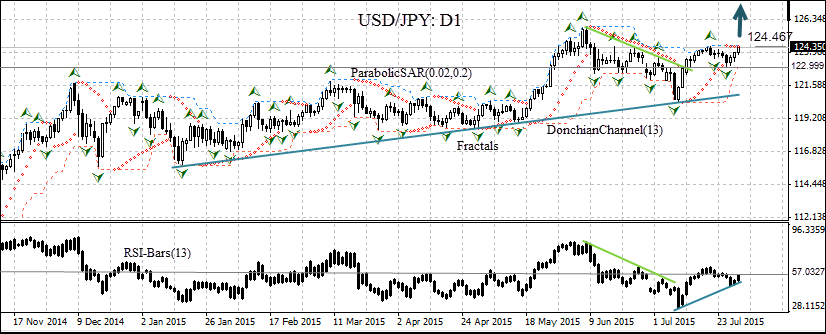

USD JPY Technical Analysis - USD JPY Trading: 2015-07-31

No change in direction

Let us consider USD/JPY pair on the daily timeframe. On October 31, 2014 the Bank of Japan expanded its quantitative easing program by announcing it will implement 80 trillion yen ($665 billion) annual purchases of Japanese government bonds, up from previous 60-70 trillion yen purchases. The yen weakened further after the QE expansion, boosting exporter profits. Two days before the Bank of Japan announcement the Federal Open Market Committee announced the end of its QE program, and subsequent FOMC statements indicated the Federal Reserve planned to start normalizing interest rates as the US economy moved towards maximum employment and 2 percent inflation. Since then the divergent monetary policies of the Federal Reserve and the Bank of Japan have been driving the pair higher. The FOMC July 28-29 meeting statement indicated the policy makers are on a path to raise interest rates later this year as they said US economic activity has been expanding moderately in recent months, and labor market continued to improve with solid job gains and declining unemployment. The statement strengthened the US dollar, and on July 30 second quarter US GDP data are expected to further boost the dollar as they show US economy grew 2.5%, while the first quarter growth will likely be revised higher.

The USD/JPY started retracement from the maximum value this year on June 8 after a news report that Obama had called the strong dollar "a problem" in conversation at the G20 summit in Germany. A day later the head of the Bank of Japan said the yen was unlikely to fall further because it was already "very weak", causing a more than 1% decline in the pair. The fall continued as investors lost appetite for risk after Greek debt negotiations unraveled, and Chinese stock market sell off on July 8 spurred increase in demand for safe haven yen. The price started rising afterward as Greek government agreed to creditors’ austerity demands for third bailout loan and Chinese authorities propped the stock market by injecting additional liquidity and pledging further monetary easing measures to support equity markets. After a downward correction last week the pair started rising as the FOMC meeting started on July 28. The Donchain channel has an upward bias. The RSI-Bars oscillator is above 50% level and rising, still far from overbought zone. We believe the bullish momentum will continue after the pair closes above the last fractal high and upper Donchian channel at 124.467, which will also reverse the Parabolic indicator toward the green zone. The stop loss can be placed below the last fractal low at 122.999. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Buy |

| Buy stop | above 124.467 |

| Stop loss | below 122.999 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.