- Analytics

- Technical Analysis

Platinum Technical Analysis - Platinum Trading: 2015-10-09

Platinum rebounds reversing the trend

Platinum price is rebounding after the scandal with Volkswagen emission test. The scandal contributed to the fall of the price below $900 an ounce for the first time in about seven years. Will the positive momentum help reverse the downward trend?

The investigation into cheating of emission tests involving 11 million Volkswagen diesel cars hurt the demand for diesel cars with catalytic converters containing platinum, pushing the platinum price lower. The price has been falling since the start of 2015 as demand for platinum declined while the production increased. According to the World Platinum Investment Council’s Platinum Quarterly, refined platinum production grew in 2015 from 1.315 million ounces in the first quarter of 2015 to 1.535 million ounces in the second quarter. In the same period demand declined in the automotive, jewelry and industrial sectors. On the otherhand, falling prices spur demand, particularly for jewelry, which will help push the price up. And on the supply side platinum production is expected to fall 15-20% in South Africa in coming years after decreasing 20% in the past eight years, providing additional support for platinum.

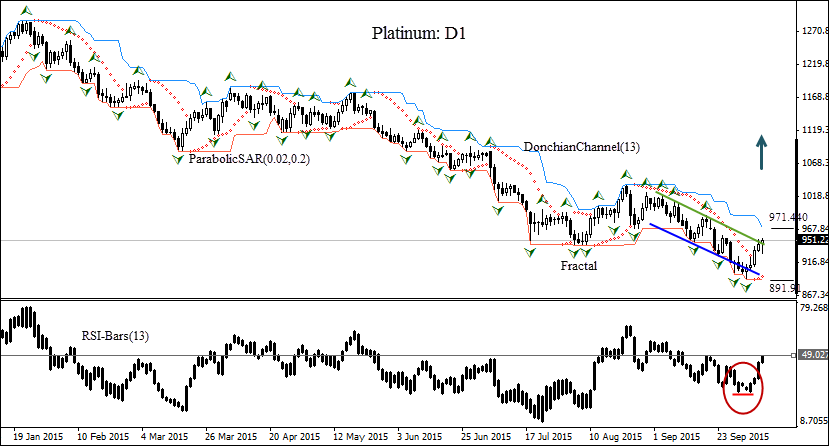

XPTUSD had been falling on the daily timeframe since the beginning of September and continued moving within the downward channel after the Volkswagen emission scandal broke on September 18. It has rebounded in the last five sessions and is about to break above the upper channel. The Parabolic indicator has formed a buy signal. The RSI-Bars oscillator is also rising, confirming the uptrend. It has formed a bullish divergence with the price, providing an additional signal for trend reversal. We expect the bullish momentum will continue after the price closes above the upper bound of Donchian channel at 971.44. A pending order to buy can be placed above that level, with the stop loss below the lower Donchian bound at 891.91. After placing the pending order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not considered.

| Position | Buy |

| Buy stop | above 971.44 |

| Stop loss | below 891.91 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.