- Analytics

- Technical Analysis

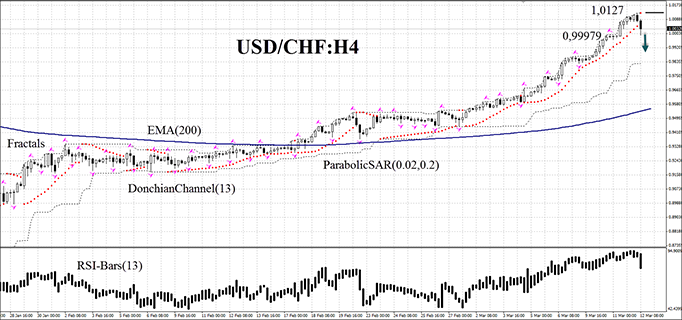

USD CHF Technical Analysis - USD CHF Trading: 2015-03-12

Looking forward to US dollar pullback continuation

Today the US dollar index is falling back. American macroeconomic performance looks so sustainable that some market participants began to doubt whether the Fed rate hike is likely to happen soon. In anticipation of the continuing dollar depreciation, a position on any currency pair might be opened. However, we suggest considering the Swiss franc. In comparison with the EU, the Swiss economy looks better. The country’s Q4 GDP rose 1.9% vs 0.9% (yoy). Unemployment rate in Switzerland is 3.2% and in the euro zone – 11.2%. Note that the ECB started printing money in the amount of 60 billion euro per month, but in Switzerland the same program is not carried out. Most likely, the price dynamics of the franc against the US dollar will be determined by the US statistics in the next few days. The next macroeconomic reports will be released in Switzerland on the 16th of March.

The USD/CHF currency pair showed a strong uptrend for a long time on the H4 chart. Now there is a sign of a slight pullback and the price hasn’t formed a fractal high yet. It deviated strongly from its exponential moving average. Donchian Channel boundaries have already widened, but the price has reached neither the upper nor the lower lines. The RSI indicator is going down and out of the overbought level. Besides, it is much higher than the level of 50. We do not rule out the bearish momentum being developed after the last USD/CHF candlestick is closed below the last fractal high at 0.99979. Stop loss is to be placed at the last Parabolic point and/or the upper Donchian Channel boundary, which can now act as the resistance line at 1.0127. After pending order placing, Stop loss is to be moved every four hours near the next fractal high, following Parabolic and Donchian Channel signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes which were not considered.

| Position | Sell |

| Sell stop | below 0.99979 |

| Stop loss | above 1.0127 |

Dear traders. For the detailed report of the strategy based on analytical issues of technical analysis click here.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.