- Analiz

- Teknik analiz

USD/CAD Teknik Analiz - USD/CAD Ticaret: 2015-01-23

CPI expectations

Today at 14:30 CET two indicators of Canadian domestic demand will be released: Core CPI and Core Retail Sales. Core CPI is published by the Statistics Canada at the end of each month and shows the change in prices of goods and services, excluding the most volatile items: food and energy (they have a strong seasonal component). The indicator measures inflation, which in turn affects the monetary policy and basic rates. The Bank of Canada takes inflationary expectations into account to suppress outpacing economy growth by monetary policy tightening. The rate hike results in an inflow of investment capital in the country’s economy. This is why the CPI release may lead to a significant boost of the Canadian dollar against the most liquid currencies. In turn, Retail sales indicator shows the sales volume change, excluding automobiles (20% of the total volume). CRS assess consumer spending trends. It is based on retailers sampling of different types and sizes. The indicator measures consumer confidence and may be very meaningful for long-tern investors. We deem that the release of both indicators will cause the Canadian dollar fluctuations against the most liquid currencies.

Let’s consider the USD/CAD on the H4 chart. According to the graphic analysis, there are two signs of the instrument position strengthening: the H4 support trend line is broken and bullish candlestick pattern "absorption" was formed. All this time the price has been moving along the upper DonchianChannel boundary, forming new highs. At this moment, there is a short-term pullback within the price channel and it can be used to open a position before a new bullish momentum. Stop Loss is to be placed below 1.23258. This mark is confirmed by Bill Williams fractal and Parabolic historical values, which mark a new support line. The price trend is confirmed by the uprising RSI-Bars oscillator which is ready to break the resistance level at 85.8333%. We expect it will accompany the price crossing at 1.24195. This mark can be used for placing a pending buy order. After order opening, Stop Loss is to be moved after Parabolic values near the next fractal low. Thus, we are changing the probable profit/loss ratio to the breakeven point.

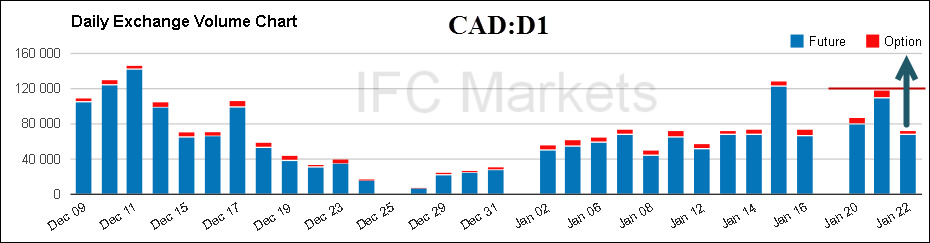

Currently, the volume of CAD futures traded on the Chicago Mercantile Exchange doesn’t confirm the trend: the level of 120 000 contracts hasn’t been outperformed. This situation is connected to a temporary pullback and volatility accumulation. The most cautious investors are recommended to wait for the breakout of this level to verify the bullish market. For tracking trading volumes, please visit the Chicago Mercantile Exchange (CME) website.

| Position | Buy |

| Buy stop | above 1.24195 |

| Stop loss | below 1.23258 |

Dear traders. For the detailed report of the strategy based on analytical issues of technical analysis click here.

Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.