- Analiz

- Teknik analiz

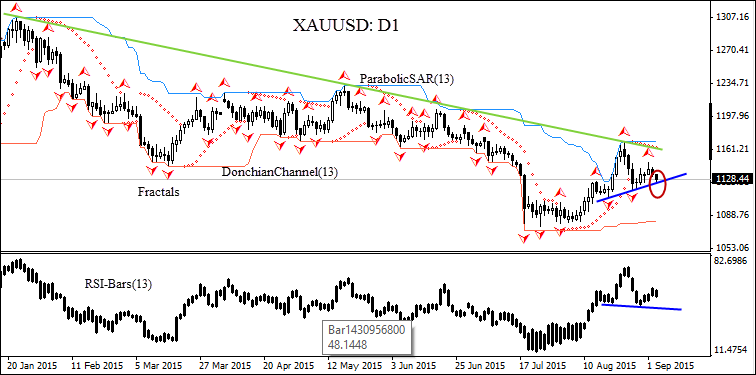

Altın Teknik Analiz - Altın Ticaret: 2015-09-03

XAUUSD is expected to fall. Waiting for US nonfarm payrolls report

Gold price is falling after Automatic Data Processing Inc. report on Wednesday indicated US economy added 190,000 jobs in July, more than the 177,000 increase in June. Federal Reserve’s Beige book the same day said there were wage pressures building as labor market continued tightening. Commerce department report on Thursday showed US trade deficit fell in July to its lowest level in five months as exports rose broadly. On Friday August employment report will be released ahead of Federal Reserve's September 16-17 policy meeting, and nonfarm payrolls are expected to increase by 217,000. Positive data indicating further improvement in labor markets and underlying strength of US economy increase the likelihood the Federal Reserve may raise interest rates at its meeting. This is a bearish factor for gold as higher interest rates increase the opportunity costs of investment in gold and other assets which offer no income from ownership.

Gold price is falling on the daily timeframe. The Parabolic indicator gives a sell signal. The price has formed a head-and-shoulders pattern, and breaking below the neckline will indicate the bearish momentum continues. The RSI-Bars oscillator has formed a more bearish head-and-shoulder pattern with a neckline tilted downward. We believe the downward momentum will continue after the price closes below the neckline, which will provide the first signal for opening a short position. More conservative traders can wait for the price to close below the last fractal low at $1117.45. A pending order to sell can be placed below that level. The stop loss can be placed above the last fractal high at $1147.60. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus we are changing the probable profit/loss ratio to the breakeven level. It is still possible for the bearish momentum to run out of steam with bulls gaining the upper hand if the actual increase in nonfarm payrolls is significantly lower than expected as it will make the case for rate hike less compelling. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Sell |

| Sell stop | below 1117.45 |

| Stop loss | below 1147.60 |

Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.