- Analytik

- Technische Analyse

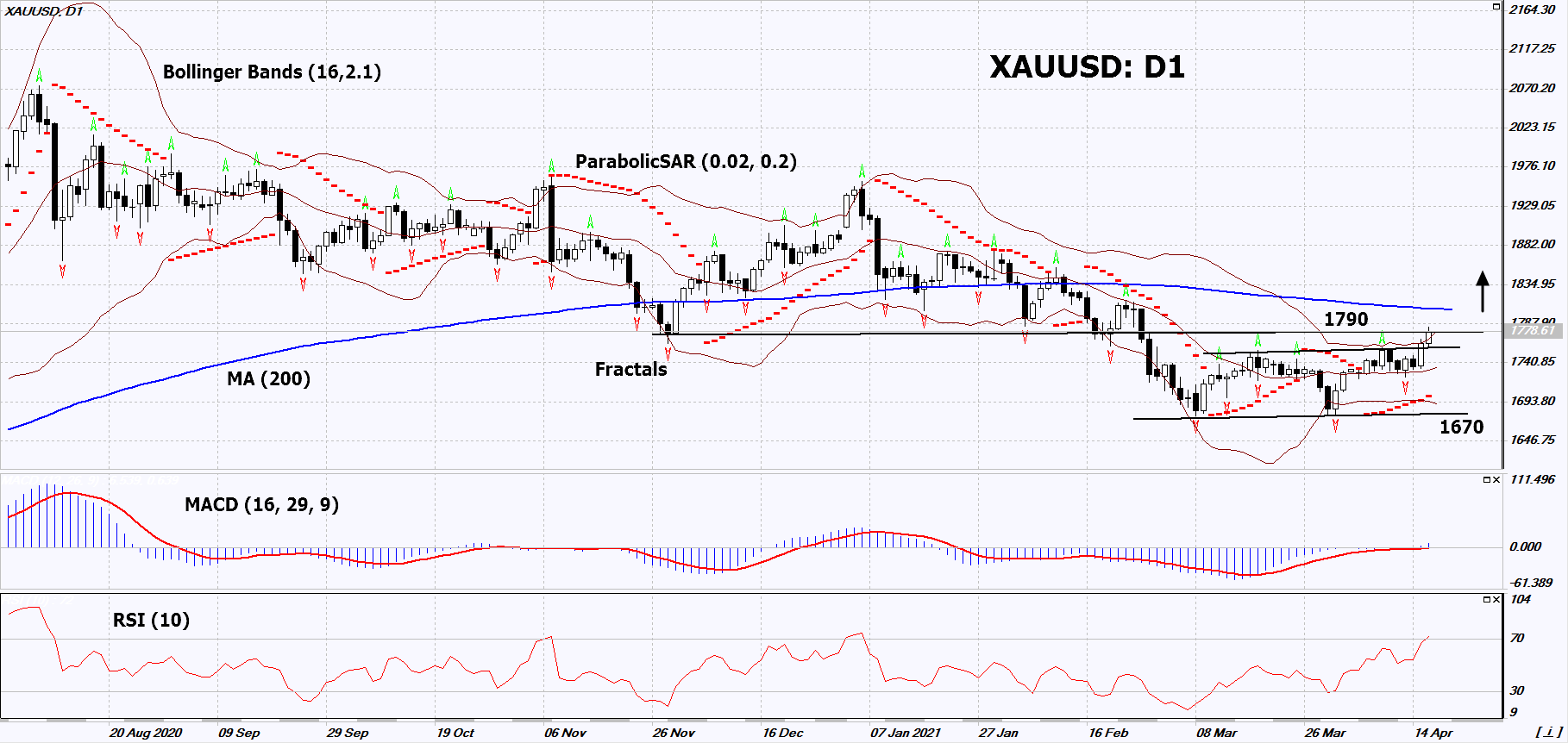

Gold Technische Analyse - Gold Handel: 2021-04-19

Gold Technical Analysis Summary

Above 1790

Buy Stop

Below 1670

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Neutral |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

Gold Chart Analysis

Gold Technische Analyse

On the daily timeframe, XAUUSD: D1 went up from the neutral range. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish move if XAUUSD rises above the last high: 1790. This level can be used as an entry point. We can place a stop loss below the Parabolic signal, the lower Bollinger line and the last lower fractal: 1670. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop loss (1670) without activating the order (1790), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Fundamentale Analyse Edelmetalle - Gold

Precious metals are rising in price amid an increase in demand in China and the weakening of USD. Will the growth of XAUUSD quotes continue?

The US dollar has been depreciating for the 2nd week in a row. US President Joe Biden’s large-scale $4 trillion stimulus plan is driving up inflation, which showed in March the highest monthly increase of 0.6% since August 2012. In annual terms, inflation in the United States reached 2.6%. This is much higher than the Fed rate (+ 0.25%). Nevertheless, representatives of the American regulator announced they would continue to keep the main parameters of their monetary policy - the low rate (0.25%) and monthly asset repurchases in the amount of $120 billion. After that, the US 10 Year Treasury Yield fell to 1.58% per annum from 1.75% in early April. The decline in the United States dollar index in the past week was the largest this year. All this has increased the demand for precious metals as an alternative to investments in US currency and assets. An additional positive for them was the growth of retail sales in the United States in March by 9.8% in monthly terms. In addition, People's Bank of China (PBOC) raised the limit on gold imports to China by 120 tons due to strong domestic demand. In March, Chinese GDP grew by 18.3% yoy. The increase in retail sales in March was a record 34.2% yoy.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.