- Analytics

- Market Overview

Fed meeting starts today - 12.6.2018

Consumer staples lead US stocks advance

US stock markets extended gains Monday led by consumer staples shares. The S&P 500 gained 0.1% to 2782 with eight of its 11 sectors finishing higher. Dow Jones industrial advanced less than 0.1% to 25322.31. The Nasdaq composite index rose 0.2% to record high 7659.93. The dollar strengthening continued: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up 0.03% to 93.572 and is rising currently. Stock index futures indicate higher openings today.

Treasury yields inched up ahead of the Federal Reserve two-day meeting starting today. It is widely expected that the central bank will hike rates a quarter percentage points when the meeting concludes tomorrow. Today at 14:30 CET May inflation report will be released. Confirmation of expectations of rising inflation by data will provide more support to the view policy makers may opt for more aggressive tightening. In such case investors expect the dot plot, the policy makers’ projections for monetary policy, will show central bank officials plan four rate hikes this year.

FTSE 100 leads major European indices gains

European stock indices recovered on Monday led by Italian shares as country’s finance minister said the new government was committed to the euro. The British Pound turned lower against the dollar while euro climbed, and both currencies are moving lower currently. The Stoxx Europe 600 index gained 0.7%. The DAX 30 added 0.6% to 12842.91 and France’s CAC 40 ended 0.4% higher. UK’s FTSE 100 rose 0.7% to 7737.43. Indices opened 0.3% - 0.8% higher today.

The Pound fell after report UK factory output contraction accelerated from 0.1% over month in March to 1.4% in April. The slowing of UK manufacturing makes it less likely the Bank of England will hike interest rates again this year.

Asian indices advance

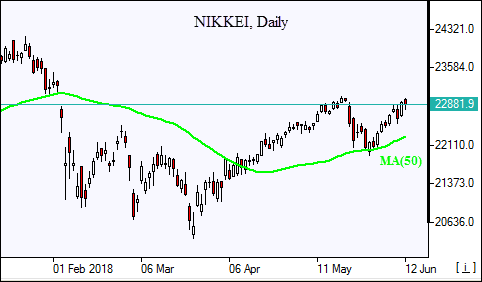

Asian stock indices are rising today as President Trump and North Korean leader Kim Jong Un signed a ‘comprehensive’ deal in Singapore aimed at the denuclearization of the Korean peninsula. Nikkei rose 0.3% to 22878.35 as yen slide against the dollar slowed. Chinese stocks are rising: the Shanghai Composite Index is up 0.9% and Hong Kong’s Hang Seng Index is 0.3% higher. Australia’s All Ordinaries Index added 0.2% despite the Australian dollar’s continued rise against the US dollar.

Brent up

Brent futures prices are rising today. Prices ended flat Monday as reports Saudi Arabia and Russia increased output offset supply concerns about Iran and Venezuela. August Brent crude settled unchanged at $76.46 a barrel on Monday.

See Also