- Analytics

- Market Overview

Health care stocks lead US equities higher - 18.10.2017

SP 500, Dow close at new record highs

US stock indices continued the rally on Tuesday as positive earnings reports boosted investor confidence. The dollar strengthening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 93.493. The S&P 500 added less than 0.1% settling at fresh record 2559.36 led by health care stocks. Dow Jones industrial average rose 0.2% closing at all-time high 22997.44, led by 4.9% jump in UnitedHealth shares on better than expected earnings and profit outlook. The Nasdaq composite index meanwhile slipped less than half a point to 6623.66.

The dollar was supported by reports that President Trump was impressed by Stanford University economist John Taylor whom he met last Wednesday in his search for a new chair of the Federal Reserve. Taylor is considered a more hawkish candidate than current chair Yellen whose term expires in February. Yellen is also on Trump’s short list, and Trump will meet her this Thursday. Positive economic news also supported the dollar and market sentiment: US import prices rose 0.7% in September, the biggest gain in more than a year thanks to fuel prices and industrial goods. Industrial production grew 0.3% in September, in line with expectations. The home builders index for October rose to five month high 68 from 64 in September.

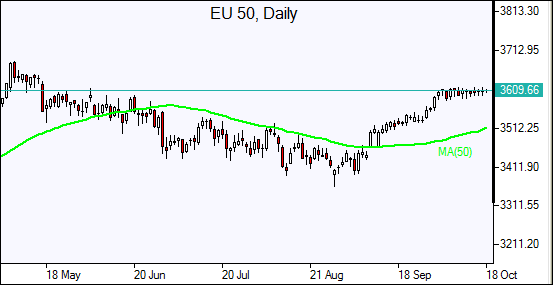

European stocks slip

European stocks closed lower on Tuesday in a choppy trade after mixed earnings reports. Both the euro and British Pound accelerated their decline against the dollar. The Stoxx Europe 600 lost 0.3% led by health care stocks. German DAX 30 fell 0.1% closing at 12995.06 despite improved ZEW economic sentiment report. France’s CAC 40 closed less marginally lower and UK’s FTSE 100 lost 0.1% to 7516.17. Markets opened 0.1%-0.2% higher today.

Spanish stocks fell as uncertainty about Catalonia independence declaration persisted. The Pound slid against the dollar on continued gridlock in Brexit talks despite a report inflation hit 3% in September. The report German ZEW economic sentiment index rose to 17.6 in October from 17 in September missed expectations: a reading of 20 was forecast.

Asian markets rise as China’s party congress starts

Asian stock indices are mostly higher as investors watch closely for any changes in China’s economic policies at the week-long part congress which started today. Nikkei rose 0.2% to 21372.50 supported by continued yen slide against the dollar. Chinese stocks are mixed: the Shanghai Composite Index is 0.3% higher and Hong Kong’s Hang Seng Index is down 0.03%. Australia’s All Ordinaries Index gained 0.02% as Australian dollar pared earlier gains against the greenback.

Oil advances on US crude stock drop report

Oil futures prices are extending gains today on expected drop in US crude inventories. The American Petroleum Institute industry group reported late Tuesday US crude stocks dropped by 7.1 million barrels last week. Prices rose yesterday on tensions between the US and Iran and fighting in Iraqi Kurdistan. President Trump last week refused to certify Iran’s compliance over a nuclear deal. US Congress has 60 days to decide on further action against Tehran. Some 1 million barrels per day of oil was cut from global markets during the previous round of sanctions against Iran. December Brent crude rose 0.1% to $57.88 a barrel on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also