- Analytics

- Market Overview

Markets slide as Syria tensions rise - 12.4.2018

Minutes show Fed discussed need to slow US economy

US stocks pulled back on Wednesday on rising geopolitical tensions after president Trump’s tweet indicating he was preparing a missile strike in Syria. The S&P 500 slid 0.6% to 2642.19 with nine of 11 main sectors ending lower. The Dow Jones industrial fell 0.9% to 24189.45. Nasdaq composite index lost 0.4% to 7069.03.The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.1% to 89.498. Stock indices futures indicate mixed openings today.

Tensions rose after a tweet from President Trump warned Russia to get ready because missiles “will be coming, nice and new and ‘smart!’” as a response to a suspected Assad led chemical weapons attack alleged to have killed civilians in the rebel held town of Douma over the weekend. Economic data were mixed: the consumer price index fell 0.1% in March, while the core CPI, which excludes food and energy precise, rose 0.2%. Meanwhile the federal government’s budget deficit was $209 billion in March, up 18% from the same month a year ago. And the minutes from the Federal Reserve’s latest policy meeting showed policy makers discussed the need to slow the economy.

DAX paces European indices pullback

European stocks turned lower on Wednesday on rising regional tensions after president Trump’s tweets indicated US plans a military strike in Syria. Both the euro and British Pound added to their gains against the dollar and are rising still. The Stoxx Europe 600 fell 0.6%. Germany’s DAX 30 dropped 0.8% settling at 12293.97. France’s CAC 40 fell 0.6% and UK’s FTSE 100 slipped 0.1% to 7257.14. Indices opened flat today.

In economic news European Central Bank President Mario Draghi, speaking at a Frankfurt event tied to an ECB competition for students, cautioned that the threat of tariffs could undermine investor confidence.

Asian indices lower

Asian stock indices are lower today as Syria tensions rose after President Trump tweeted about impending military strike. Nikkei ended 0.1% lower at 21660.28 despite yen pullback against the dollar. China’s stocks are lower after Commerce Ministry said the country would “fight back without any hesitation” and isn’t currently engaged in talks with Washington: the Shanghai Composite Index is 0.9% lower and Hong Kong’s Hang Seng Index is down 0.3%. Australia’s All Ordinaries Index is down 0.2% with Australian dollar little changed against the greenback.

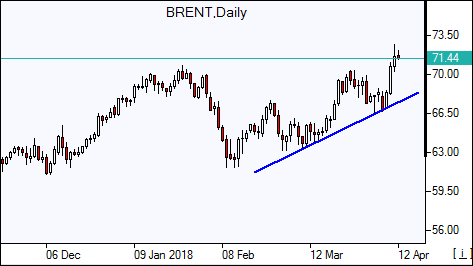

Brent lower

Brent futures prices are retreating today after hitting three-year high on Tuesday on rising Syria tensions. Prices rose yesterday despite a US supply build: the US Energy Information Administration reported Wednesday that domestic crude supplies climbed by 3.3 million barrels last week. June Brent crude rose 1.4% to $72.06 a barrel on Wednesday.

See Also