- Analytics

- Market Overview

Positive earnings lift US stock market - 7.8.2018

Nasdaq logs fifth straight gain

US stock market added to previous session gains on Monday led by technology and financial shares. The S&P 500 gained 0.4% to 2850.40. Dow Jones industrial added 0.2% to 25502.18. The Nasdaq composite index rose 0.6% to 7859.68. The dollar strengthened still more: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 95.349 but is lower currently. Stock index futures indicate higher openings today.

Positive earnings reports buoyed market sentiment. Of the 413 S&P 500 companies that have reported second-quarter results so far, 79.2% have exceeded earnings estimates, according to Thomson Reuters data. That compares with the 72% average for the past four quarters. However trading was somewhat thinner than usual: trading volume on US exchanges was 5.95 billion shares, compared to the 6.29 billion average for the last 20 trading days.

Fall in German factory orders weighs on euro

European stocks pulled back on Monday as US and China continued the exchange of new tariff threats. The British Pound and euro continued the decline against dollar but both pairs are moving higher currently. The Stoxx Europe 600 index slipped 0.1%. The DAX 30 lost 0.1% to 12598.21 and France’s CAC 40 fell less than 0.1%. UK’s FTSE 100 however inched up 0.1% to 7663.78. Indices opened 0.3% - 0.5% higher today.

Pound ended lower after UK international trade secretary Liam Fox comment over the weekend that there is a 60% chance that Britain will leave the European Union without a deal with the bloc. Weak German manufacturing data weighed on euro: German manufacturing orders plunged in June by 4%.

Chinese stocks lead Asian indices gains

Asian stock indices are mostly higher today. Nikkei gained 0.2% to 22562.10 lifted by surprise earnings beat by SoftBank despite yen turn higher against the dollar. Chinese stocks are rebounding: the Shanghai Composite Index is up 2.5% and Hong Kong’s Hang Seng Index is 1.6% higher. Australia’s All Ordinaries Index is down 0.3% as the Australian dollar resumed advancing against the greenback.

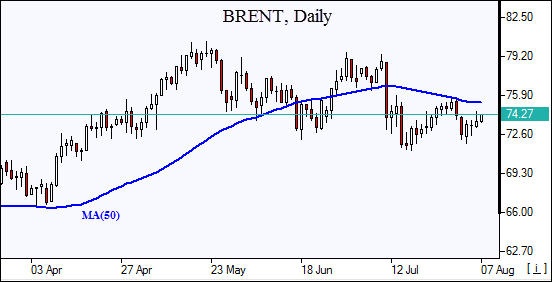

Brent rises

Brent futures prices are extending gains today as the United States reimposed sanctions against major crude exporter Iran. Prices ended higher Monday over Saudi Arabia output decline and expectations of sanctions on Iran which may block more than 1 million barrels a day of Iran’s roughly 2.5 million barrels a day of crude exports. October Brent crude settled 0.7% higher at $73.75 a barrel on Monday.

See Also