- Analytics

- Market Overview

Stocks end lower as Fed signals another hike soon - 2.8.2018

Dollar holds gains as Fed leaves rates unchanged

US stocks pulled back slightly on Wednesday after the Federal Reserve left interest rates unchanged but signaled a rate increase in September. The S&P 500 slipped 0.1% to 2813.36. The Dow Jones industrial average lost 0.3% to 25333.82. Nasdaq composite index however gained 0.5% to 7707.29.The dollar strengthening slowed: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, added 0.1% to 94.637 and is higher currently. Stock index futures indicate lower openings today.

The Fed left its benchmark overnight lending rate in a range of 1.75% - 2.00%. However it stated “Economic activity has been rising at a strong rate,” instead of characterizing economy's growth rate as 'solid' like it did in its June statement. Federal funds futures indicate traders are pricing in about a 91% chance of a rate rise in September and a 71% chance of an additional hike in December, according to CME Group’s FedWatch data.

DAX 30 leads European indices losses

European stocks retreated on Wednesday on a mixed batch of corporate reports. The British Pound turned higher against the dollar while euro accelerated its decline and both are lower currently. The Stoxx Europe 600 lost 0.5%. Germany’s DAX 30 ended 0.5% lower at 12737.05. France’s CAC 40 slipped 0.2% and UK’s FTSE 100 slumped 1.2% to 7652.91. Indices opened 0.1% - 1% lower today.

The Bank of England is expected to hike rates to 0.75% from 0.5% at a meeting today with the statement scheduled at 13:00 CET. In economic news the final reading on Markit’s manufacturing PMI in the euro-zone in July came in unchanged at 55.1. Readings above 50 indicate expansion in business activity.

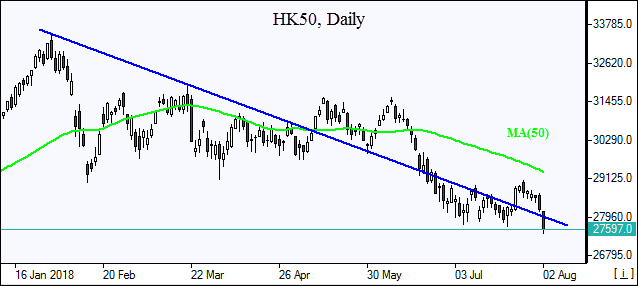

Chinese shares lead Asian indices losses

Asian stock indices are falling today after US administration on Wednesday increased pressure on China for trade concessions by proposing a higher 25% percent tariff on $200 billion worth of Chinese imports instead of 10% announced earlier. Beijing responded by saying “China will inevitably take countermeasures.” Nikkei ended 1% lower at 22512.53 as the yen climb against the dollar continued. China’s stocks are sharply lower: the Shanghai Composite Index is down 2% and Hong Kong’s Hang Seng Index is 2.4% lower. Australia’s All Ordinaries Index lost 0.6% despite continued Australian dollar decline against the greenback.

Brent lower on big US crude stocks build

Brent futures prices are lower today after the Energy Information Administration reported Wednesday that domestic crude supplies rose by 3.8 million barrels last week. Prices ended sharply lower yesterday: October Brent crude fell 2.5% to $72.39 a barrel on Wednesday.

See Also