- Analytics

- Market Overview

Upbeat earnings lift markets - 18.4.2018

Dow turns positive for 2018

US stock indices closed solidly higher Tuesday on positive earnings reports. The S&P 500 climbed 1.1% to 2706.39 led by technology and consumer discretionary shares. All 11 main sectors ended higher. Dow Jones industrial average gained 0.9% to 24786.63, turning positive for the year. The Nasdaq composite index outperformed rising 1.7% to 7281.10. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.1% to 89.45. Stock indices futures indicate higher openings today.

Upbeat earning reports boosted investors risk appetite as traders anticipate SP 500 companies earnings to grow 17.3% in the first quarter buoyed by recent tax cut, according to FactSet. Positive economic data also supported the market sentiment: housing starts rose 1.9% in March after 3.3% decline in February. And industrial production in March rose 0.5%, above forecast of a 0.3% gain.

DAX leads European indices rally

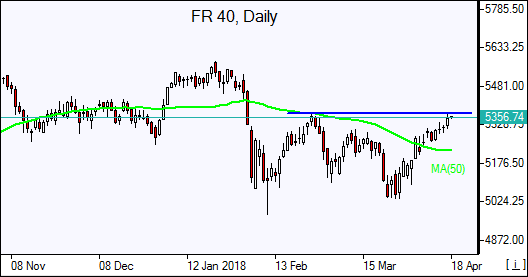

European stocks rallied Tuesday despite weak economic reports. Both the euro and British Pound switched to losses against the dollar but are rising currently. The Stoxx Europe 600 rose 0.8%. The German DAX 30 jumped 1.6% to 12585.57. France’s CAC 40 gained 0.8% and UK’s FTSE 100 rose 0.4% to 7226.05. Indices opened flat to 0.2% higher today.

UK’s FTSE 100 index erased earlier losses and ended higher after Pound reversed earlier gains as wage growth including bonuses came in up 2.8% for February, below an expected 3%. The German ZEW survey results showed forecasts for economic conditions and sentiment in euro-zone and its largest economy deteriorated in April more than expected.

Nikkei leads Asian indices rebound

Asian stock indices are rising today supported also by easing of tensions over North Korea. Nikkei rose 1.4% to 22185.20 helped by yen turning lower against the dollar. Chinese stocks are rising after China’s central bank cut the amount of money lenders need to keep in reserve by 1 percentage point Tueday: the Shanghai Composite Index is up 0.9% and Hong Kong’s Hang Seng Index is 1% higher. Australia’s All Ordinaries Index is up 0.3% with Australian dollar edging lower against the greenback after minutes from the last meeting of the Reserve Bank of Australia indicated interest rates would be on hold for an extended period.

Brent advances

Brent futures prices are edging higher today as traders expect US inventories fell last week. The American Petroleum Institute late Tuesday report indicated US crude inventories fell by 1 million barrels last week to 428 million. Prices rose yesterday: June Brent gained 0.2% to $71.58 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also