- Analytics

- Market Overview

US markets rebound on tax reform hopes - 21.11.2017

All three main indices advance

US major stock indices ended higher on Monday supported by positive earnings results and tax cuts hopes. The dollar strengthened as euro slid on German coalition talks collapse: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.4% to 94.046. S&P 500 closed 0.1% higher settling at 2582.14 led by telecom and technology shares. The Dow Jones industrial average rose 0.3% to 23430.33. The Nasdaq composite index added 0.1% to 6790.71.

Chances for tax bill’s Senate approval improved after the White House said it would support removing Obamacare repeal provision from the bill if necessary for passage. Earlier Susan Collins, the Republican Senator from Maine, had voiced her doubts about the measure and with the Demaocrats expected to vote against the tax plan Republicans need every vote as they have only a slim majority in the Senate. The economic data were positive: the Index of Leading Economic Indicators rose 1.2% signaling continued strong US growth.

European markets rise despite German coalition talks collapse

European stocks rebounded on Monday in choppy trade erasing earlier losses after German coalition talks collapsed Sunday. The euro fell against the dollar while British Pound extended gains. The Stoxx Europe 600 index ended 0.7% higher. The DAX 30 rose 0.5% to 13058.66. France’s CAC 40 gained 0.4% and UK’s FTSE 100 added 0.1% to 7389.46. Indices opened lower today.

Higher political uncertainty weighed on euro as coalition negotiations between Merkel’s center-right Christian Democrats and Bavarian Christian Social Union, the pro-business Free Democrats and the Green Party collapsed late Sunday as the FDP walked out on talks. German President Frank Walter Steinmeier urged the parties to return to the negotiating table and cooperate to avoid new elections. Merkel said she preferred new elections over a minority government.

Technology stocks lead Asian indices higher

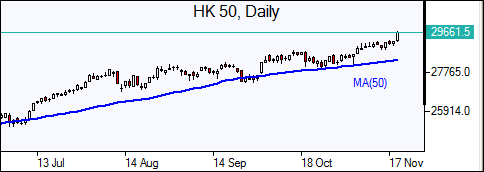

Asian stock indices are rising today led by technology shares after an upbeat Wall Street session overnight. Nikkei closed 0.7% higher at 22425.00 helped by a weaker yen against the dollar. Chinese stocks are rising led by messaging and gaming giant Tencent, up 1.8%: the Shanghai Composite Index is 0.6% higher and Hong Kong’s Hang Seng Index is up 1.3%. Australia’s All Ordinaries Index is 0.3% higher as Australian dollar hit a five-month low against the US dollar after central bank meeting minutes.

Oil edges higher

Oil futures prices are inching higher today. Prices fell Monday as traders were in wait and see mode ahead of the OPEC November 30 meeting. January Brent crude lost 0.8% settling at $56.42 a barrel on Monday.

See Also