- Analytics

- Market Overview

US stocks advance despite weaker-than-expected jobs report - 6.8.2018

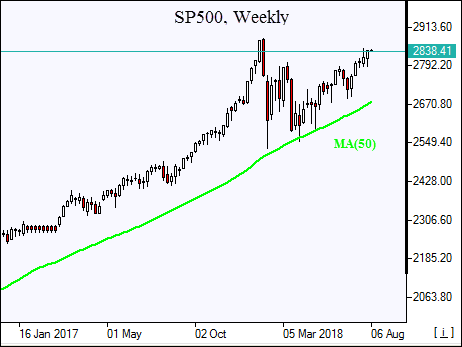

SP500 logs second consecutive weekly gain

US stock market extended gains Friday on strong earnings reports. S&P 500 rose 0.5% to 2840.35, ending 0.8% higher for the week. Dow Jones industrial average gained 0.5% to 25462.58. The Nasdaq added 0.1% to 7812.01. The dollar continued strengthening despite a smaller than expected rise in nonfarm payrolls by 157,000 in July: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up less than 0.1% to 95.142 and is higher currently. Stock index futures point to mixed openings today.

European stocks snap four-week gains

European stocks recovered on Friday led by technology shares lifted by Apple’s rally Thursday. Both the British Pound and euro extended losses against the dollar and both currencies are lower currently. The Stoxx Europe 600 Index gained 0.7%, ending 0.7% lower for the week. The DAX 30 rose 0.6% to 12615.76. France’s CAC 40 added 0.3% and UK’s FTSE 100 gained 1.1% to 7659.10. Indices opened flat to 0.2% higher today.

Asian indices mixed

Asian stock indices are mixed today after China’s finance ministry announced Friday new sets of additional tariffs on 5,207 goods imported from the United States worth $60 billion. Nikkei lost 0.1% to 22507.32 despite the yen turn lower against the dollar. Chinese stocks are mixed as China’s central bank set reserve requirement ratio of 20% for financial institutions settling foreign exchange forward dollar sales to clients: the Shanghai Composite Index is down 1.3% while Hong Kong’s Hang Seng Index is 0.4% higher. Australia’s All Ordinaries Index is up 0.6% asthe Australian dollar turned lower against the greenback.

Brent gains on surprise Saudi Arabia output dip

Brent futures prices are inching higher today after Saudi Arabia data showing it pumped around 10.29 million barrels per day (bpd) of crude in July, down about 200,000 bpd from a month earlier. Prices fell Friday on signs of rising global supplies: Brent for October settlement lost 0.3% to close at $73.21 a barrel Friday, ending 2.1% lower for the week.

See Also