- Analytics

- Market Overview

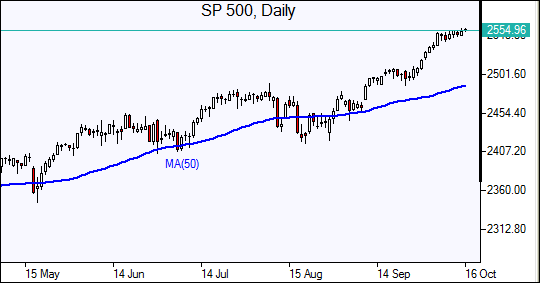

US stocks rise on weak inflation report - 16.10.2017

Nasdaq ends at record high

US stock indices closed higher on Friday on positive earnings reports. The dollar was little changed despite slowing core inflation in September: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched down 0.01% to 93.08. S&P 500 rose 0.1% to 2553.17, led by technology and materials shares. Dow Jones industrial average added 0.1% to 22871.72 supported by gains in American Express and McDonald’s shares. The Nasdaq composite index outperformed gaining 0.2 % to record high 6605.80.

The first reports from banks were generally better than expected and investors expect a strong season of third quarter corporate results. In economic news wholesale prices rose 0.4% in September contributing to an annual growth rate of 2.6%, the fastest pace since 2012. Initial jobless claims fell 15 thousand to 243 thousand, lowest level in six weeks. Fed Governor Jerome Powell said emerging markets should be able to withstand higher US rates which could strengthen the dollar.

European stocks advance

European stocks ended higher on Friday. The euro continued slide against the dollar on reports the European Central Bank may continue asset purchases for at least nine months after it starts tapering in January. The British Pound extended gains against the dollar. The Stoxx Europe 600 index ended the session up 0.2%. The DAX 30 rose 0.1% to 12991.87. France’s CAC 40 slipped 0.2% and UK’s FTSE 100 lost 0.3% to 7535.44. Indices opened higher today.

Spanish stocks reversed some of previous session gains as concerns about Catalonia independence declaration subsided. Spain’s Prime Minister Mariano Rajoy’s demand on Wednesday that Catalonia President clarify whether he declared independence in his speech before parliament was interpreted as a signal by Rajoy hi intends to suspend Catalonia’s autonomy. In economic news euro-zone’s industrial production was better than expected in August, rising 1.4% on month after 0.3% gain in July.

Asian markets up on Chinese data

Asian stock indices are mostly higher today on strong Chinese data. China’s producer prices beat market expectations to rise 6.9% in September from a year earlier while consumer inflation slowed to 1.6% form 1.8% in August. Nikkei rose 0.6% to 21284.40 despite a weaker dollar against the yen. The belief that Japan’s ruling party bloc will win the general election later this month supported market sentiment. Chinese stocks are mixed: the Shanghai Composite Index is down 0. 4% while Hong Kong’s Hang Seng Index is 0.8% higher. Australia’s All Ordinaries Index is up 0.6% supported by a weaker Australian dollar against the greenback.

Oil higher on Iraq export concerns

Oil futures prices jumped today on output concerns over OPEC’s second largest producer as Iraqi forced entered the oil city of Kirkuk, taking territory from Kurdish fighters. Prices rose Friday after President Donald Trump’s refusal to certify Iran’s compliance with the nuclear deal. December Brent ended 0.6% higher at $57.17 a barrel on Friday, gaining 2.8% for the week.

See Also