- Analytics

- Market Overview

US stocks slip as trade war fears persist - 16.3.2018

Dow snaps three day decline

US stocks slipped on Thursday on potential global trade war fears. However Dow Jones industrial average advanced 0.5% to 24873.66. The S&P 500 slid 0.1% to 2747.33. The Nasdaq composite fell 0.2% to 7481.74. The dollar accelerated strengthening: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.4% to 90.111. Stock indices futures point to higher openings today.

Economic data were positive after mixed reports Wednesday showing falling retail sales. Both the Philadelphia Fed and Empire State manufacturing indexes were well above zero, indicating improving conditions. And the import price index rose 0.4% in February though the increase was slower compared with 0.8% gain in January. Initial jobless claims declined by 4,000 to 226,000, a 50-year low.

European stocks turn higher

European stocks recovered on Thursday on bargain hunting. Both the euro and British Pound extended losses against the dollar. The Stoxx Europe 600 index rose 0.5%. Germany’s DAX 30 rallied 0.9% to 12345.56. France’s CAC 40 climbed 0.7% and UK’s FTSE 100 added 0.1% to 7203.24. Indices opened flat to 0.1% lower today.

The insurance and technology shares were among the strongest performers as political uncertainty after President Trump ordered import tariffs on steel an aluminum continued to weigh on market sentiment.

Asian indices mixed as US tariff concerns linger

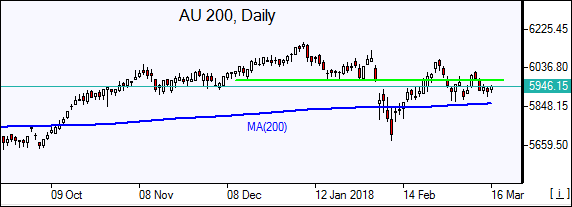

Asian stock indices are mostly lower today with traders watching closely world markets reaction to US import tariffs on steel and aluminum and plans to impose tariffs on up to $60 billion of Chinese imports. Nikkei fell 0.6% to 21684.50 as yen accelerated its rise against the dollar. Chinese stocks reversed previous session gains: the Shanghai Composite Index is 0.6% lower and Hong Kong’s Hang Seng Index is down 0.3%. Australia’s All Ordinaries Index is up 0.5% with Australian dollar steady against the greenback.

Brent rising

Brent futures prices are extending gains with rising supply from the US limiting upside. Prices rose yesterday on signs of growing global crude demand. The International Energy Agency revised upward by 90,000 barrels to 1.5 million barrels a day global oil demand growth in 2018. Brent for May settlement rose 0.4% to close at $65.12 a barrel on Thursday.

See Also