- Analytics

- Market Sentiment

Dollar bearish bets decline accelerated as US inflation rose

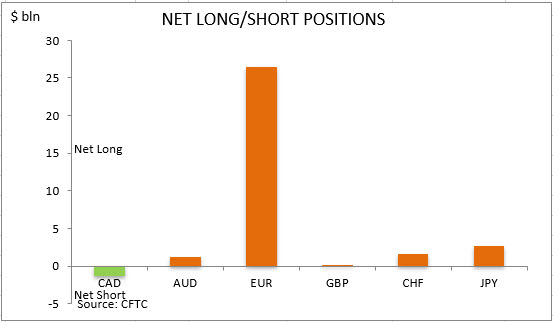

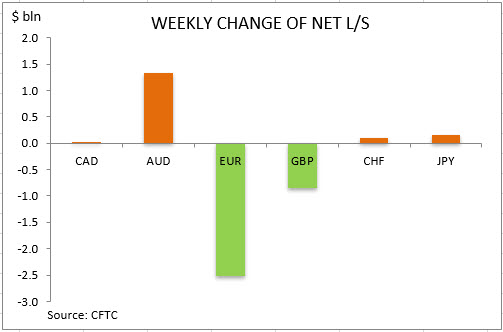

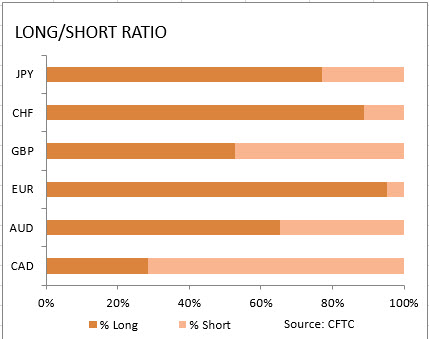

US dollar net short bets decrease speeded up with total net shorts falling to $30.9 billion from $32.67 billion against the major currencies during the one week period, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to September 15 and released on Friday September 18. The drop in net short dollar bets was the result of mainly decline in bullish bets on euro after consumer prices in Germany continued to decline in August though the disinflation slowed as consumer prices index declined 0.1% over month, in line with forecasts, after 0.5% drop in July. Dollar bearish bets slipped as the Labor Department report showed US consumer price index for August rose 0.4% when a 0.3% growth was expected, while above-expected 884 thousand Americans filed for first-time jobless benefits in the previous week.

CFTC Sentiment vs Exchange Rate

| September 15 2020 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bearish | negative | -1285 | 26 |

| AUD | bullish | negative | 1183 | 1330 |

| EUR | bullish | negative | 26445 | -2516 |

| GBP | bullish | negative | 185 | -848 |

| CHF | bullish | negative | 1661 | 91 |

| JPY | bullish | positive | 2714 | 149 |

| Total | 30903 |

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Last Sentiments

- 18Mar2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies...

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies...