- マーケット分析

- 市場概観

Equities advance in volatile trading - 12.28 日

Dollar weakens on softer consumer confidence

US stock market added to post-Christmas gains on Thursday in a volatile session. The S&P 500 gained 0.9% to 2488.83. The Dow Jones industrial average rose 1.1% to 23138.82. Nasdaq composite index added 0.4% to 6579.49. The dollar weakening resumed as Conference Board reported its consumer confidence index declined to 128.1 in December from a revised 136.4 in November: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.5% to 96.56 and is lower currently. Stock index futures point to higher openings today.

DAX 30 leads European indexes losses

European stock markets fell sharply on Thursday after reopening following Christmas holidays. Both the GBP/USD and EUR/USD turned higher and are rising currently. The Stoxx Europe 600 index fell 1.7%. Germany’s DAX 30 fared the worst sinking 2.4% to 10381.51, dragged by 2.6% drop in Siemens. France’s CAC 40 slid 0.6% and UK’s FTSE 100 ended 1.5% lower at 6584.68. Futures indicate higher openings today.

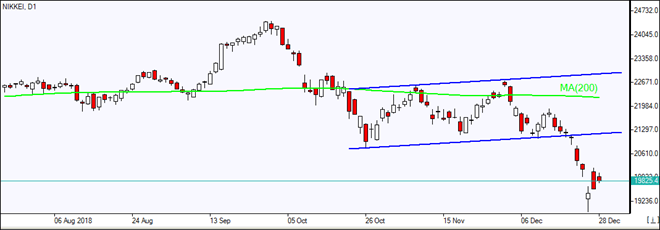

Nikkei pulls back as industrial production falls

Asian stock indices are mostly higher. Nikkei pulled back 0.3% to 20014.77 as data showed unemployment rose in November to 2.5%, from 2.4% in October, and industrial production fell 1.1% from the previous month in November with yen continuing its climb against the dollar. Chinese indices are mixed: the Shanghai Composite Index is down 0.4% while Hong Kong’s Hang Seng Index is 0.1% lower. Australia’s All Ordinaries Index extended gains 1% with Australian dollar turning higher against the greenback.

Brent higher

Brent futures prices are edging higher. The American Petroleum Institute industry group reported yesterday US crude inventories rose by 6.9 million barrels last week. Brent for February settlement closed 4.2% lower at $52.16 a barrel on Thursday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.