- Phân tích dữ liệu

- Phân tích kỹ thuật thị trường

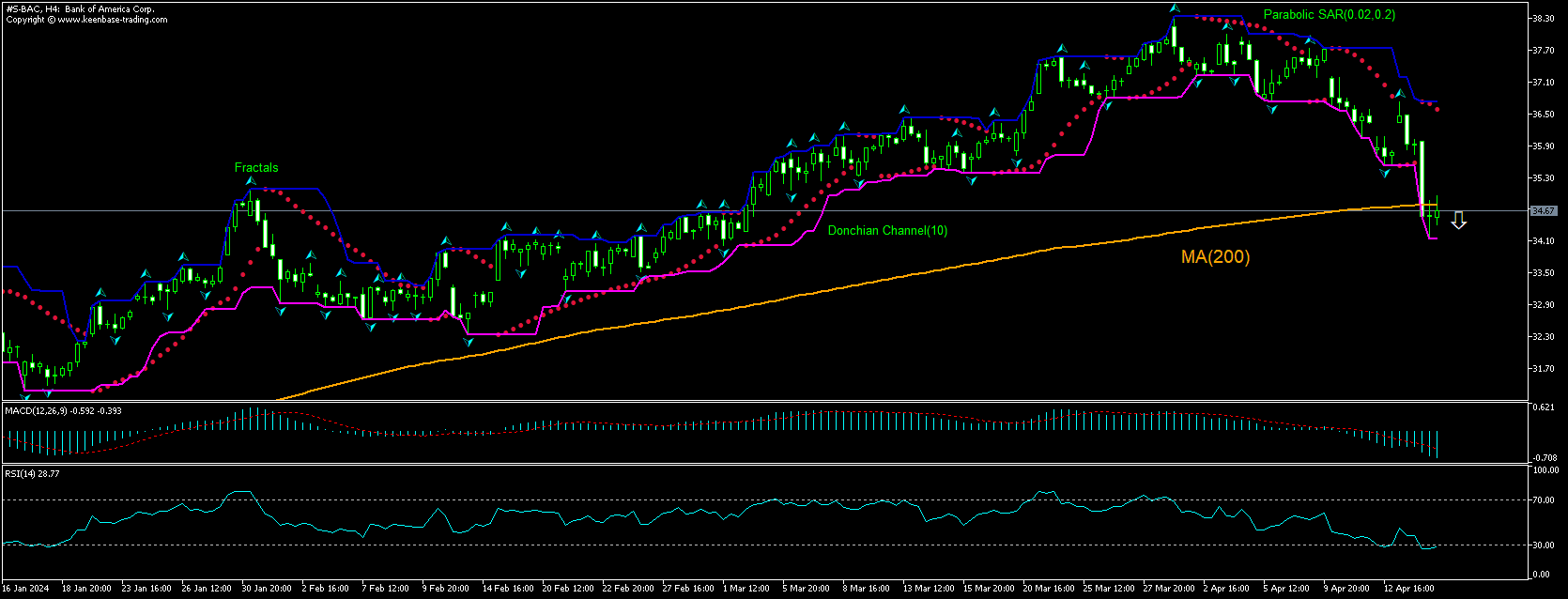

Bank of America Phân tích kỹ thuật - Bank of America Giao dịch: 2024-04-17

Bank of America Tổng quan phân tích kỹ thuật

Dưới 34.14

Sell Stop

Trên 36.73

Stop Loss

| Chỉ thị | Tín hiệu |

| RSI | Mua |

| MACD | Bán |

| Donchian Channel | Trung lập |

| MA(200) | Bán |

| Fractals | Bán |

| Parabolic SAR | Bán |

Bank of America Phân tích biểu đồ

Bank of America Phân tích kỹ thuật

The technical analysis of the Bank of America stock price chart on 4-hour timeframe shows #S-BAC,H4 has fallen under the 200-period moving average MA(200) which is rising itself. The RSI is about to leave the oversold zone. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 34.14. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the fractal high at 36.73. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (36.73) without reaching the order (34.14), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Phân tích vĩ mô Cổ phiếu - Bank of America

Bank of America stock fell after the company reported better than expected revenue and earnings. Will the Bank of America stock price continue retreating?

Bank of America beat first quarter revenue and earnings estimates yesterday but the stock ended 3.5% lower for the day. The bank reported revenue of $25.82 billion, exceeding the Wall Street consensus estimate of $25.46 billion. However the revenue was down 2% year over year as higher investment banking and trading revenues were unable to offset lower net interest income. Bank of America reported a 18% drop in first-quarter profit as the bank reported higher expenses and charge-offs of bad loans that exceeded expectations. Charge-offs for bad loans totaled $1.5 billion, up 26% from the final three months of 2023 and significantly above the $1.26 billion analysts had expected. The company attributed the higher-than-expected charge-off number to an increase in credit card issues, but stated that the number is flattening out. The bank stated that its unrealized losses on a $587 billion portfolio of bonds that are classified as held to maturity for accounting purposes widened by $11 billion to $109 billion on March 31 from $98 billion at year-end 2023. Bank of America has by far the largest bond losses in the banking industry.

Lưu ý:

Bài tổng quan này mang tính chất tham khảo và được đăng miễn phí. Tất cả các dự liệu trong bài viết được lấy từ các nguồn thông tin mở và được công nhận đang tin cậy. Nhưng không có bất kỳ đảm bảo nào rằng thông tín hoàn toàn đang tin cậy. Sau này không điều chỉnh lại nữa. Tất cả thông tin trong bài tổng quan, bao gồm ý kiến, chỉ số, biểu đồ và khác chỉ mang tính chất tham khảo và không phải là lời khuyên đầu tư. Tất cả bài viết này không được xem xét như lời khuyên thúc đẩy để giao dịch. Công ty IFC Markets và nhân viên không chịu trách nghiệm cho bất kỳ quyết định của khách hàng sau khi đọc xong bài tổng quan.