- Analytics

- Market Overview

Important economic indicators will be released in US today - 24.11.2021

Todays’ Market Summary

Top daily news

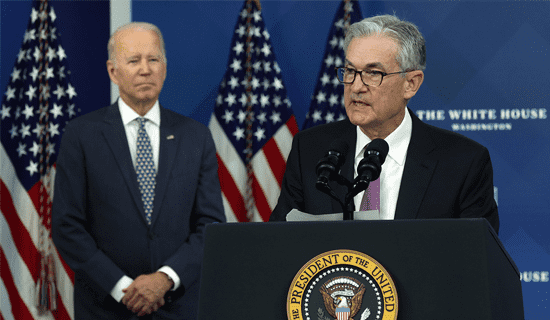

Investors reacted positively to the re-election of Fed Chairman Jerome Powell for the second term. Yesterday, the US dollar index rose for the third day in a row and hit a fresh 16-month high. Significant amount of data concerning important economic indicators will be published in USA, today. Consumer countries have allocated very little oil from their strategic reserves to stabilize prices. Nevertheless, investors believe that because of this, OPEC + at the next meeting on December 2, will not increase production above the usual limit of 400 thousand barrels per day. November 25th is a Thanksgiving holiday in the United States

Forex news

| --- | --- | --- | |

| --- | --- | --- | |

| --- | --- | --- | |

| USD/JPY | --- | --- | --- |

On Tuesday, the US dollar index rose for the third day in a row and hit a fresh 16-month high. Investors reacted positively to the re-election of Fed Chairman Jerome Powell for a second term. They are hoping for a rate hike next year. The euro strengthened slightly yesterday despite the introduction of quarantine in a number of European countries due to the coronavirus. The positive impact was made by the growth of the Markit Manufacturing PMI Flash PMI for November in Germany and the Eurozone. The Reserve Bank of New Zealand raised rates this morning to 0.75% from 0.5%, but so far this has not had a positive impact on the New Zealand dollar. Remember that inflation in New Zealand in the 3rd quarter of 2021 reached its maximum in 10 years and amounted to 4.9% in annual terms. The Turkish lira plummeted by more than 15% in a day. Investors reacted negatively to the statement of Turkish President Tayyip Erdoğan about the need to cut rates despite high inflation - about 20% in annual terms. Bitcoin quotes have stabilized in a narrow range of $ 55,000-60,000. Investors are trying to assess the tightening of cryptocurrency turnover in a number of countries. The Financial Services Commission (FSC) of South Korea announced the introduction of a 20% tax on income from virtual assets from January 1, 2022.

Stock Market news

Yesterday, the US stock indices S&P500 and Dow Jones rose thanks to good economic performance. The Markit Manufacturing PMI Flash (59.1) rose more-than-expected in November. The recent drop in bitcoin quotes and expectations of an increase in Fed rates contributed to the increase in the S&P500 bank industry index by 2%. S&P500 energy climbed 3% on the back of higher oil prices. The hi-tech Nasdaq fell yesterday for the second day in a row. Tesla plummeted 4% after the announcement of the sale of shares in the amount of $ 1 billion by the founder of Elon Musk. Zoom Video Communications and Best Buy fell 14.7% and 12.3%, respectively. The companies lowered their forecast for their financials for the 4th quarter. Significant statistics will be published in the US today: Durable Goods Orders, 3rd quarter GDP in 2nd estimate, Michigan Consumer Sentiment, Core Personal Consumption Expenditure Price Index, New Home Sales, weekly unemployment and FOMC Minutes. As a reminder, November 25 in the United States will be a day off in connection with Thanksgiving Day.

Commodity Market news

Today oil is getting more expensive for the third day in a row. Brent is again trading above the psychological support level of $ 80 per barrel. Earlier, oil consuming countries agreed to use their strategic reserves to stabilize prices. However, in reality, the total volume of oil from reserves turned out to be very small, 70-80 million barrels. This disappointed investors who were expecting at least 100 million barrels. The United States has allocated 50 million barrels from the Strategic Petroleum Reserve (SPR), but the participation of other countries turned out to be purely symbolic. To stabilize world prices, China allocated only 7.33 million barrels of its oil reserves, Britain - 5 million, Japan - 4.2 million. Nevertheless, investors believe that OPEC + at the next meeting on December 2 will not increase production beyond the limit 400 thousand barrels per day. The independent American Petroleum Institute announced an increase in US oil reserves for the week by 2.3 million barrels. This slightly limited the rise in quotes this morning.

Gold Market News

Gold on Tuesday fell in price for the fourth day in a row on the back of the strengthening of the US dollar. The United States 10-Year Bond yield is growing for the 4th month in a row and reached 1.64% per annum. The World Platinum Investment Council raised its forecast for the global platinum surplus in 2021 and 2022. This became an additional negative for the quotes of this metal. Precious metal prices are correcting upward this morning. This is facilitated by a modest increase in the Reserve Bank of New Zealand rate by only 0.25% to 0.75%. Investors do not exclude that other central banks will also not sharply raise rates.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also