- Analytics

- Market Overview

Dow Jones industrial average surpassed 19000 points - 23.11.2016

Stock indices set records

US stock indices advanced on Tuesday on positive data on Existing Home Sales data for October.

Existing Home Sales rose 2% to $5.6mln in October compared to September. This is the 9-1/2-year high. Sales advanced 5.9% on a year basis. Due to such positive data some banks started to believe the Fed may go on with hiking rates and it may reach 2% in 2018. This pushed US dollar up. Another positive factor is the plan for first 100 days of Donald Trump as the US President. He is planning to cut taxes, raise infrastructure spending and soften demands towards investors. S&P 500 hit a fresh historical high and is traded with Р/Е of 17.3. This is far above the average Р/Е of 14.7 for recent 10 years. As a rule, higher coefficient means the stocks may be overestimated. Dow Jones industrial average index also hit a fresh historical high having surpassed for the first time the level of 19000 points. Today at 14:30 CET the durable goods orders for October and weekly unemployment data will come out in US. At 15:45 СЕТ the Markit manufacturing PMI for November will come out. At 16:00 CET the New Home Sales data for October and final Michigan University index for November will come out. At 20:00 CET the November Fed meeting minutes will come out. The tentative outlook is positive. This supports the growth of US assets on Wednesday morning. Tomorrow the US markets will be closed due to the Thanksgiving Day.

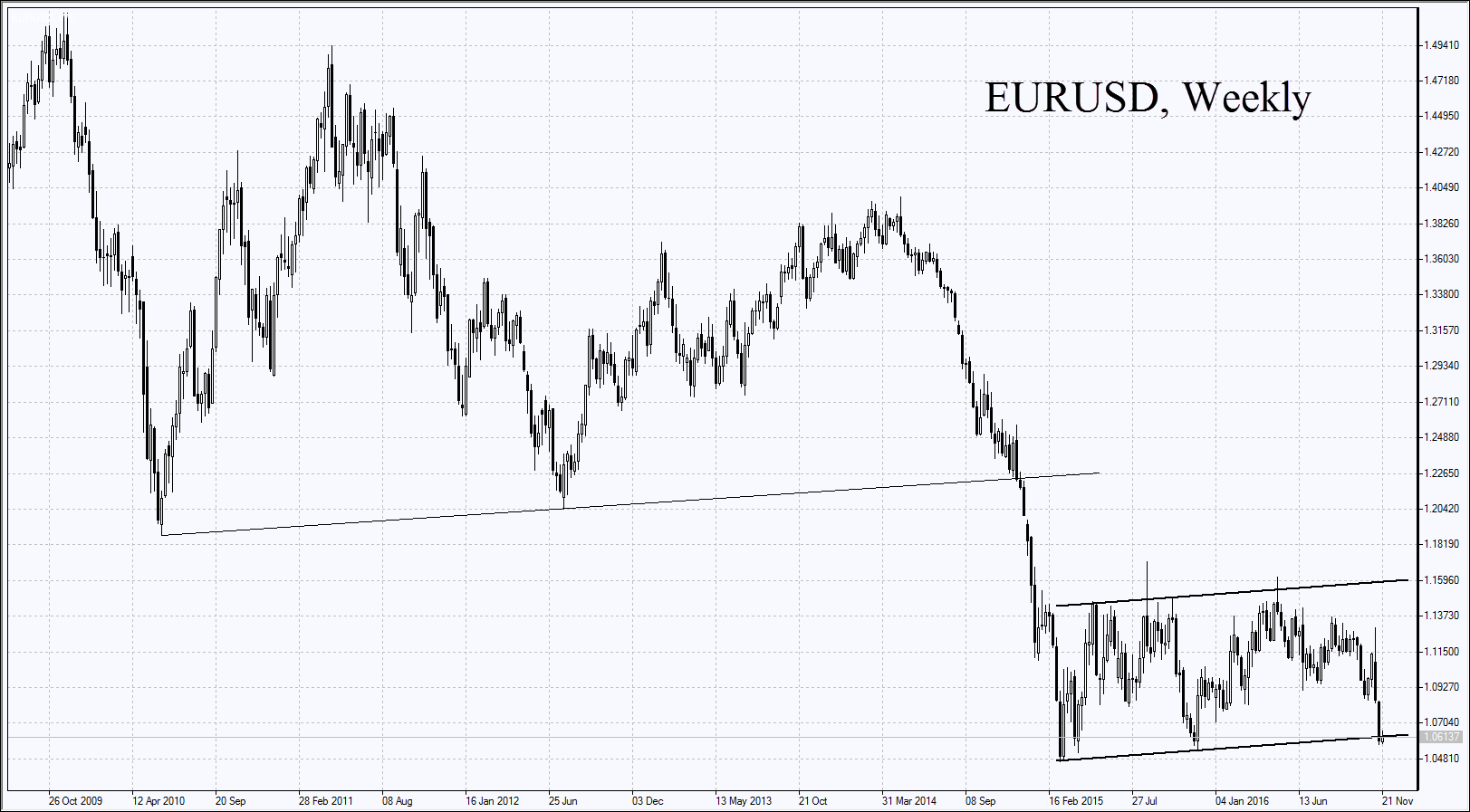

Slump of euro came to a halt

European stock indices advanced on Tuesday while euro dropped. Consumer confidence index for November was above expectations. Higher non-ferrous metals and oil prices pushed mining and energy stock up.

Banking stocks were also in demand after Italian Prime Minister Matteo Renzi said he is to resign in case his constitutional reform does not get enough support in referendum on December 4, 2016 in Italy. Market participants expect the reform not to be implemented as it may endanger EU unity. Any polls and statements in favor of reform in Italy may pull down euro and European banking sector. Positive manufacturing PMI, composite and service, came out in Eurozone on Wednesday.

Earthquake in Japan did not affect Nikkei

Nikkei continued advancing on Tuesday for 5th trading day in a row already. Earthquake took place in North of Japan which pushed yen lower. Markets believe it did not affect plants of major companies. Japanese markets will be closed on Wednesday due to the Labour Thanksgiving Day. On Thursday morning the industrial PMI for November will come out.

Oil consolidates ahead of OPEC meeting

Oil prices halted growth ahead of official OPEC meeting next week on November 30, 2016. Due to preliminary negotiations members of cartel except for Libya and Nigeria shall cut production by 4-4.5%. Now ОПЕК produces around 34mln barrels a day. Thus, after the cut the production may be 32-33mln barrels a day. Market participants believe the decline to the upper level of 33mln may support Brent to cost $55 per barrel. Two OPEC members, Iran and Iraq, still doubt they shall participate in oil output “freeze” deal. Weekly oil stockpiles data will come out in US on Wednesday. They are expected to rise by 700 thousand barrels which also prevents oil price growth.

Strong US housing market data and earthquake in Japan supported copper prices on Tuesday. Markets believe this may push up demand for this metal.News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also