- Analyses

- Analyse technique

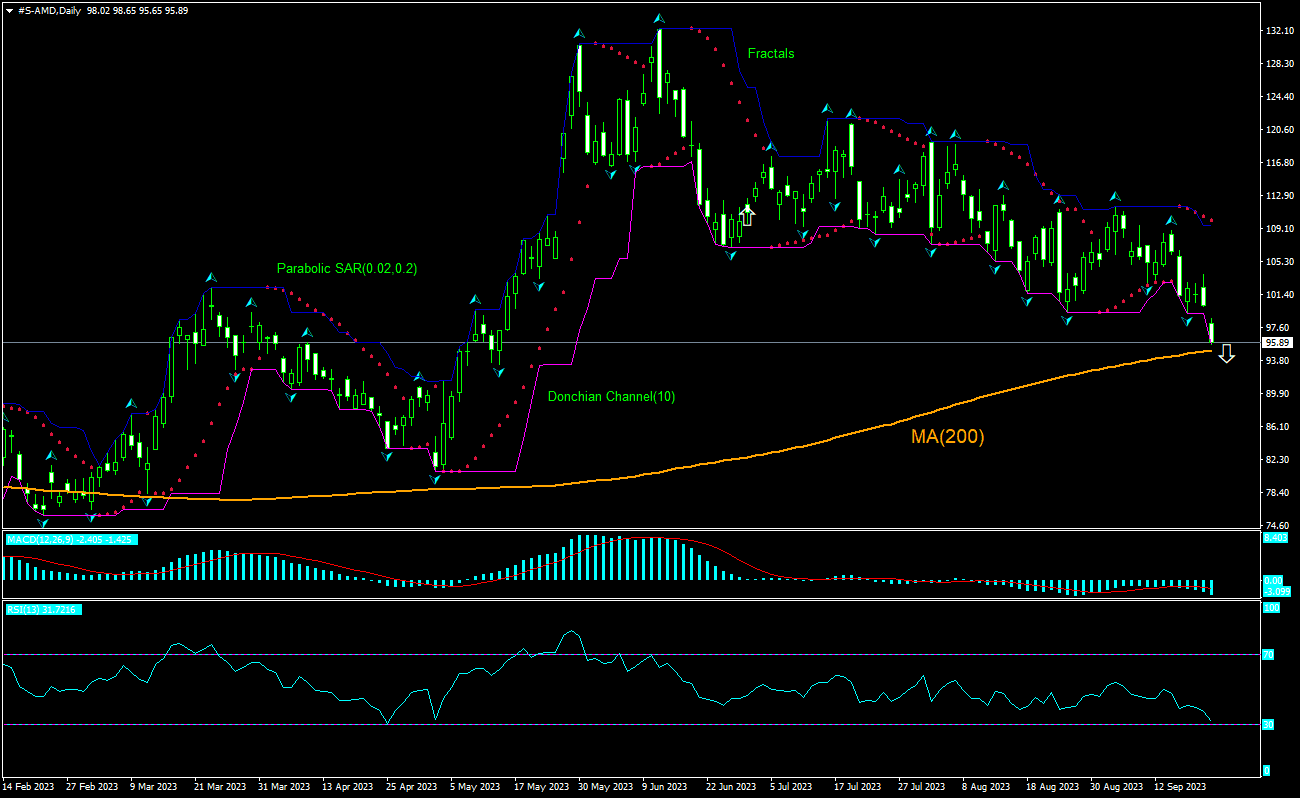

Advanced Micro Devices Inc. Analyse technique - Advanced Micro Devices Inc. Trading: 2023-09-22

Advanced Micro Devices Résumé de l'Analyse Technique

Inférieur à 95.65

Sell Stop

Supérieur de 103.74

Stop Loss

| indicateur | Signal |

| RSI | Acheter |

| MACD | Vendre |

| Donchian Channel | Vendre |

| MA(200) | Acheter |

| Fractals | Vendre |

| Parabolic SAR | Vendre |

Advanced Micro Devices Analyse graphique

Advanced Micro Devices Analyse technique

The technical analysis of the AMD stock price chart on daily timeframe shows #S-AMD,Daily is declining to test the 200-day moving average MA(200) which is starting to level off. RSI indicator is poised to enter the “Oversold “ zone. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 95.65. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 103.74. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (103.74) without reaching the order (95.65), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analyse Fondamentale de ACTIONS - Advanced Micro Devices

AMD stock continued sliding despite the chip maker’s launch of new processors. Will the AMD stock price continue retreating?

This Monday AMD announced availability of new processors from its 4th Generation EPYC CPU family of workload-optimized processors. The chip maker says new AMD EPYC™ 8004 Series processors deliver exceptional energy efficiency and strong performance in single-socket packages supported by Dell Technologies, Ericsson, Lenovo, Supermicro and others, and are validated for Microsoft Azure Stack HCI. The next day the company announced AMD Kria K24 System-on-Module (SOM) and KD240 Drives Starter Kit. These latest additions to the Kria portfolio of adaptive SOMs and developer kits offer shorter times to market for powering electric drives and motor controllers used in compute-intensive digital signal processing applications without requiring FPGA programming expertise (Field Programmable Gate Arrays - semiconductor devices that are based around a matrix of configurable logic blocks connected via programmable interconnects). The K24 SOM (commercial and industrial versions) and KD240 Drives Starter Kit are available to order now via direct order and worldwide channel distributors. Shares of the company added 0.8% on Monday but then resumed their retreating. Widening the product line by launching new processors is bullish for a chip maker’s stock price. However, the current setup is bearish for AMD stock price.

NB:

Cet aperçu a un caractère instructif et didactique, publié gratuitement. Toutes les données, comprises dans l'aperçu, sont reçues de sources publiques, reconnues comme plus ou moins fiables. En outre, rien ne garantit que les informations indiquées sont complètes et précises. Les aperçus ne sont pas mis à jour. L'ensemble de l'information contenue dans chaque aperçu, y compris l'opinion, les indicateurs, les graphiques et tout le reste, est fourni uniquement à des fins de familiarisation et n'est pas un conseil financier ou une recommandation. Tout le texte entier et sa partie, ainsi que les graphiques ne peuvent pas être considérés comme une offre de faire une transaction sur chaque actif. IFC Markets et ses employés, dans n'importe quelle circonstance, ne sont pas responsables de toute action prise par quelqu'un d'autre pendant ou après la lecture de l’aperçu.