- Analyses

- Analyse technique

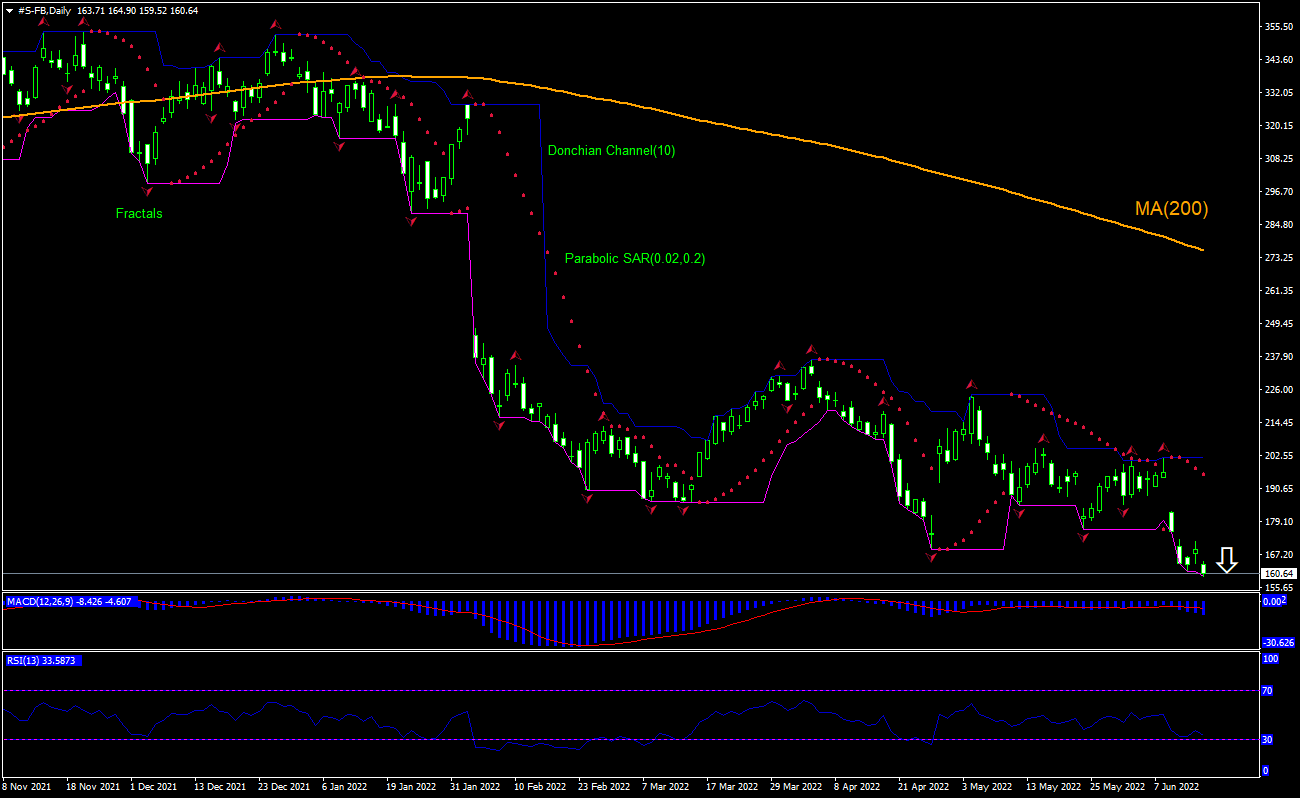

Meta Platforms Inc. Analyse technique - Meta Platforms Inc. Trading: 2022-06-17

Facebook (Meta Platforms Inc.) Résumé de l'Analyse Technique

Inférieur à 159.52

Sell Stop

Supérieur de 201.91

Stop Loss

| indicateur | Signal |

| RSI | Neutre |

| MACD | Vendre |

| Donchian Channel | Vendre |

| MA(200) | Acheter |

| Fractals | Neutre |

| Parabolic SAR | Vendre |

Facebook (Meta Platforms Inc.) Analyse graphique

Facebook (Meta Platforms Inc.) Analyse technique

The technical analysis of the Facebook stock price chart on daily timeframe shows #S-FB,Daily has fallen under the 200-day moving average MA(200) as it started retreating after hitting all-time high nine months ago. We believe the bearish momentum will resume after the price breaches below the lower boundary of Donchian channel at 159.52. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper boundary of Donchian channel at 201.91. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (159.52) without reaching the order (201.91), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analyse Fondamentale de Actions - Facebook (Meta Platforms Inc.)

Facebook’s stock closed down after news it made antitrust commitments regarding the French online advertising sector. Will the Facebook stock price continue retreating?

Meta Platforms, Inc. is an American social media giant formerly known as Facebook, Inc. which changed its name to Meta Platforms, Inc. in October 2021. Its market capitalization is $483.3 billion. The stock is trading at P/E ratio (Trailing Twelve Months) of 12.82 currently. The company earned a revenue for the trailing twelve months of $119.7 billion, Return on Assets (ttm) of 16.74% and Return on Equity (ttm) of 29.07%. Meta announced it will give access over a five-year period to advertising inventories and campaign data to so-called advertising technology companies in the French online advertising sector when a level of spending is met on its interface. Meta provides access to the advertising data through Meta Business Partner. France's anti-trust watchdog body said on Thursday it had approved commitments made by Facebook to give access on transparent, objective and predictable conditions. Facebook stock closed down 5% on the day after the news.

Explorez nos

conditions de trading

- Spreads à partir de 0.0 pip

- Plus de 30,000 instruments de trading

- Stop Out Level - Only 10%

Prêt à trader?

Ouvrir un compte NB:

Cet aperçu a un caractère instructif et didactique, publié gratuitement. Toutes les données, comprises dans l'aperçu, sont reçues de sources publiques, reconnues comme plus ou moins fiables. En outre, rien ne garantit que les informations indiquées sont complètes et précises. Les aperçus ne sont pas mis à jour. L'ensemble de l'information contenue dans chaque aperçu, y compris l'opinion, les indicateurs, les graphiques et tout le reste, est fourni uniquement à des fins de familiarisation et n'est pas un conseil financier ou une recommandation. Tout le texte entier et sa partie, ainsi que les graphiques ne peuvent pas être considérés comme une offre de faire une transaction sur chaque actif. IFC Markets et ses employés, dans n'importe quelle circonstance, ne sont pas responsables de toute action prise par quelqu'un d'autre pendant ou après la lecture de l’aperçu.