- Analytik

- Technische Analyse

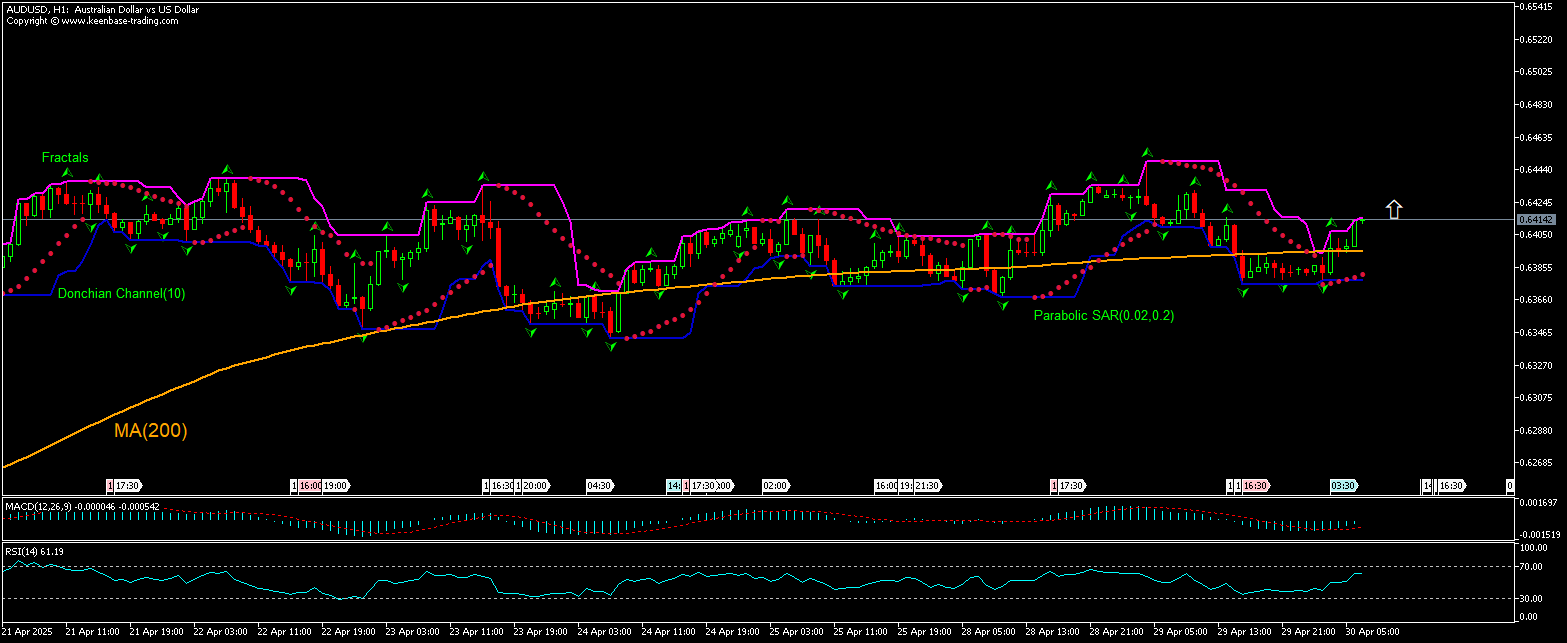

AUD/USD Technische Analyse - AUD/USD Handel: 2025-04-30

AUD/USD Technical Analysis Summary

Above 0.64173

Buy Stop

Below 0.63843

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

AUD/USD Chart Analysis

AUD/USD Technische Analyse

The technical analysis of the AUDUSD price chart on 1-hour timeframe shows AUDUSD,H1 has returned above the 200-period moving average MA(200) after falling below the MA(200) yesterday. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 0.64173. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 0.63843. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Forex - AUD/USD

Australia’s inflation remained steady in March. Will the AUDUSD price rebound continue?

Australian Bureau of Statistics reported the Consumer Price Index (CPI) increased by 2.4% over year in March, unchanged from the previous month when a decline to 2.3% was expected. The reading remained the lowest inflation rate since last November. The slowing of consumer prices for alcohol and tobacco, clothing and footwear as well as accelerating deflation in the transport sector was offset by higher prices for food and non-alcoholic beverages and housing. On a quarterly basis, consumer prices rose 2.4% in the first quarter, matching the previous quarter’s pace and slightly exceeding market expectations of 2.3%. However, core inflation eased to 2.9% from 3.3%, supporting the views of a near-term rate cut by the Reserve Bank of Australia at its meeting in May. Expectations of a rate cut by the RBA is bearish for Australian dollar and AUDUSD currency pair. However, the current setup is bullish AUDUSD.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.