- Analytik

- Technische Analyse

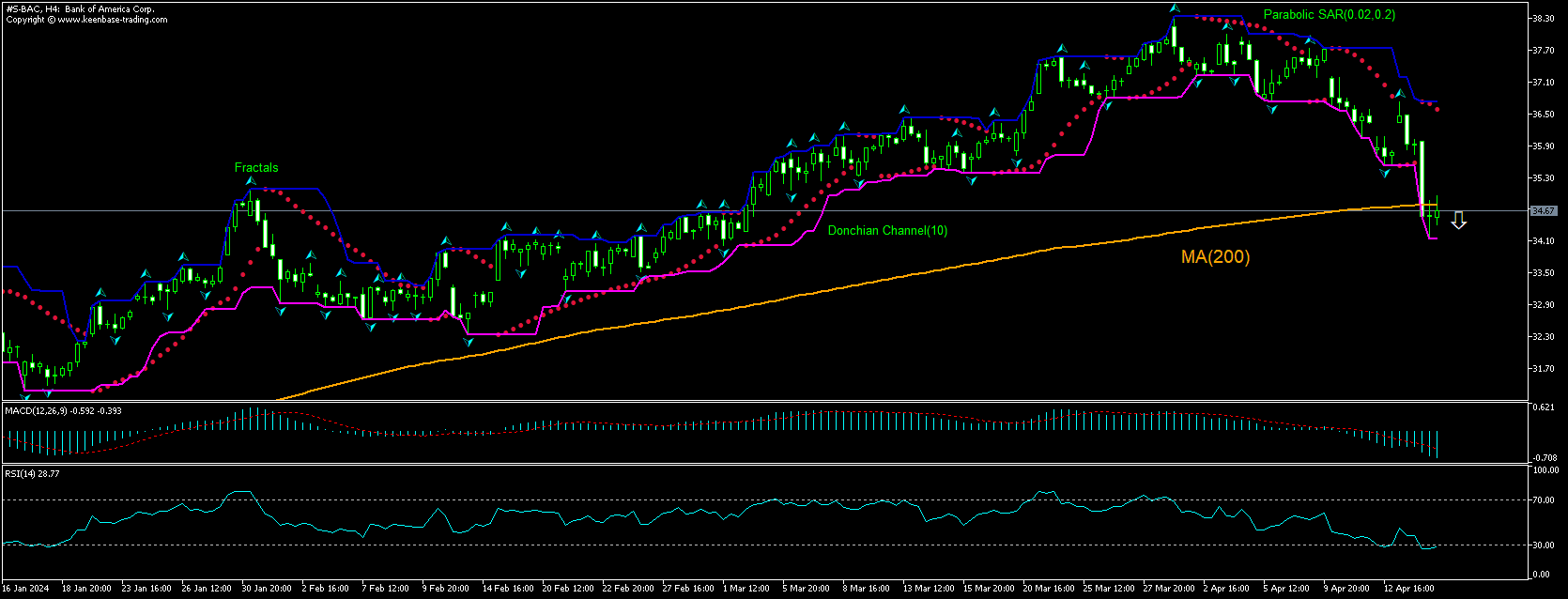

Bank of America Technische Analyse - Bank of America Handel: 2024-04-17

Bank of America Technical Analysis Summary

Below 34.14

Sell Stop

Above 36.73

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Bank of America Chart Analysis

Bank of America Technische Analyse

The technical analysis of the Bank of America stock price chart on 4-hour timeframe shows #S-BAC,H4 has fallen under the 200-period moving average MA(200) which is rising itself. The RSI is about to leave the oversold zone. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 34.14. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the fractal high at 36.73. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (36.73) without reaching the order (34.14), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Aktien - Bank of America

Bank of America stock fell after the company reported better than expected revenue and earnings. Will the Bank of America stock price continue retreating?

Bank of America beat first quarter revenue and earnings estimates yesterday but the stock ended 3.5% lower for the day. The bank reported revenue of $25.82 billion, exceeding the Wall Street consensus estimate of $25.46 billion. However the revenue was down 2% year over year as higher investment banking and trading revenues were unable to offset lower net interest income. Bank of America reported a 18% drop in first-quarter profit as the bank reported higher expenses and charge-offs of bad loans that exceeded expectations. Charge-offs for bad loans totaled $1.5 billion, up 26% from the final three months of 2023 and significantly above the $1.26 billion analysts had expected. The company attributed the higher-than-expected charge-off number to an increase in credit card issues, but stated that the number is flattening out. The bank stated that its unrealized losses on a $587 billion portfolio of bonds that are classified as held to maturity for accounting purposes widened by $11 billion to $109 billion on March 31 from $98 billion at year-end 2023. Bank of America has by far the largest bond losses in the banking industry.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.