- Analytik

- Technische Analyse

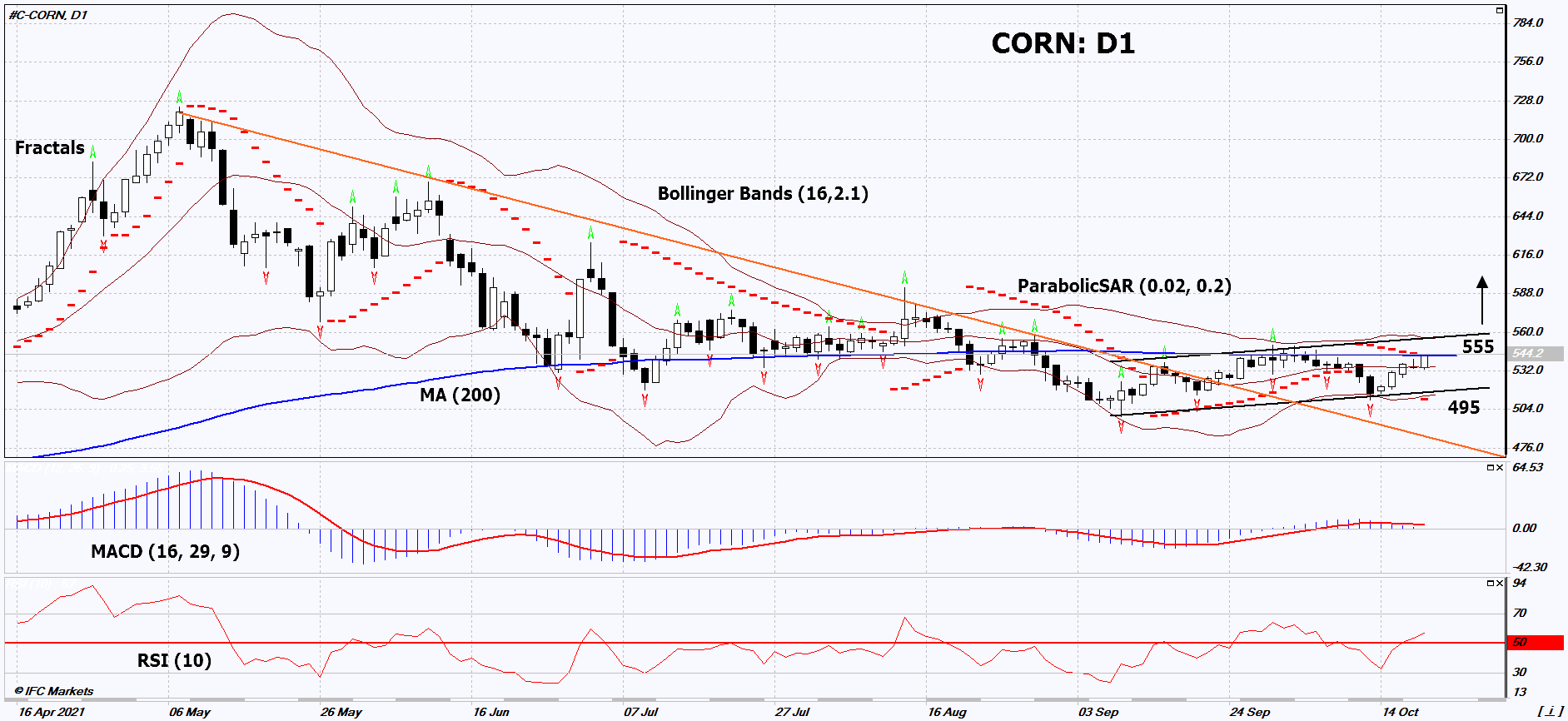

Mais Technische Analyse - Mais Handel: 2021-10-21

Mais Technical Analysis Summary

Above 555

Buy Stop

Below 495

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

Mais Chart Analysis

Mais Technische Analyse

On the daily timeframe, CORN: D1 is in an ascending channel and approached the 200-day moving average line. Before opening a position, he must overcome it. A number of technical analysis indicators have generated signals for further growth. We do not rule out a bullish movement if CORN: D1 rises above the 200-day moving average, the last upper fractal and the upper Bollinger band: 555. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, the lower Bollinger line and the last three lower fractals: 495. After opening a pending order, move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit / loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (495) without activating the order (555), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamentale Analyse Rohstoffe - Mais

Corn imports in China increased in September. Will the CORN quotes grow?

According to the General Administration of Customs of the People's Republic of China (GACC), corn imports to China in September 2021 more than tripled compared to the same month in 2020 and reached 3.5 million tons. Another factor in the rise in corn prices may be an increase in the volume of its processing for biofuels in the United States. According to the United States Department of Agriculture (USDA), U.S. ethanol production reached 1.1 million barrels per day (bpd) last week. This is the maximum volume since 2018, before the coronavirus epidemic. Ethanol is used as a biofuel. The demand for it has increased against the background of a strong growth in oil prices. Since the beginning of 2021, WTI has already risen in price by 72%, and corn by only 13%. Unlike the countries of South America, the United States uses mainly corn for the production of biofuels, rather than sugar cane. In the production of corn, the United States ranks 1st in the world, and in the production of sugar - 6th.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.