- Analytik

- Technische Analyse

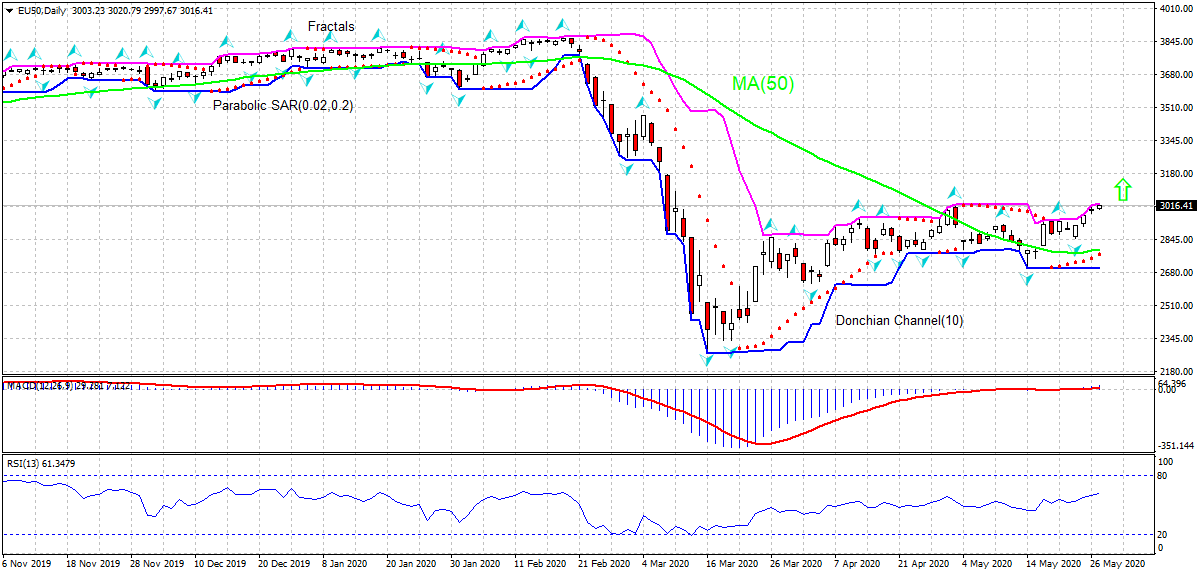

EURO STOXX 50 (SX5E) Technische Analyse - EURO STOXX 50 (SX5E) Handel: 2020-05-27

Euro Stocks 50 Index Technical Analysis Summary

Above 3017.32

Buy Stop

Below 2696.91

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Neutral |

| MA(50) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Euro Stocks 50 Index Chart Analysis

Euro Stocks 50 Index Technische Analyse

On the daily timeframe EU50: D1 has rebounded above the 50-day moving average MA(50) which has stopped falling. We believe the bullish momentum will continue after the price breaches above the upper Donchian boundary at 3017.32. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 2696.91. After placing the pending order the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (3017.32) without reaching the order (2696.91) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Fundamentale Analyse Indexe - Euro Stocks 50 Index

Euro-zone’s private business sector contraction slowed and investor sentiment improved. Will the EU50 rebound continue?

Euro area economic data in the last couple of weeks were not as bad as feared: contraction in private business sector activities slowed in May, investor morale improved further and consumer confidence improved more than expected. Markit’s Composite PMI for euro-zone went up to 30.5 in May 2020 from 13.6 in April when a reading of 25 was expected, according to preliminary estimate. Readings above 50 indicate activities expansion, below indicate contraction. The ZEW indicator of economic sentiment for the euro-zone rose from 25.2 in April to 46 in May, the highest reading since August 2015. And Eurostat survey results showed the consumer confidence index in euro-zone rose from the previous month's 11-year low -22 to -18.8 in May, when a reading of -24.0 was forecast. Readings above 0 indicate optimism, below indicate pessimism. Better data are bullish for EU50. Nevertheless, further deterioration of euro-zone’s economic performance is a downside risk: Eurostat is due to report the change in business confidence for euro area on Thursday, and a steeper than forecast deterioration is a downside risk for EU50.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.