- Analytik

- Technische Analyse

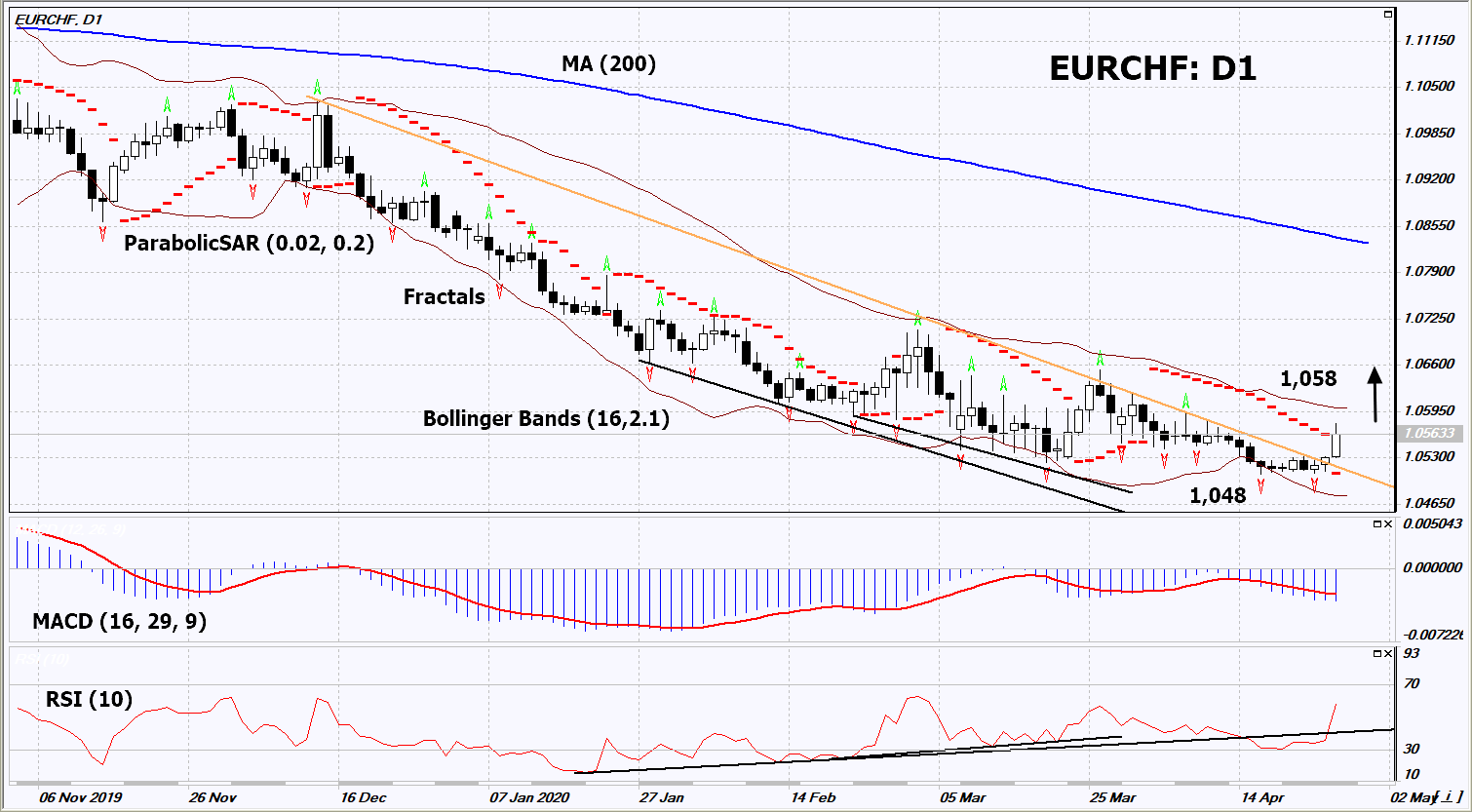

EUR/CHF Technische Analyse - EUR/CHF Handel: 2020-04-28

EUR/CHF Technical Analysis Summary

Above 1,058

Buy Stop

Below 1,048

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

EUR/CHF Chart Analysis

EUR/CHF Technische Analyse

On the daily timeframe, EURCHF: D1 moved up from the downtrend. A range of indicators of technical analysis formed signals for a further increase. We do not exclude bullish movement if EURCHF rises above its last maximum: 1,058. This level can be used as an entry point. We can set a stop loss below the last two lower fractals, the Parabolic signal and the minimum since July 2015: 1.048. After opening the pending order, we move the stop loss after the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit / loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop level (1,048) without activating the order (1,058), it is recommended to delete the order: perhaps, some internal changes in the market have not been taken into account.

Fundamentale Analyse Forex - EUR/CHF

Swiss National Bank (SNB) announced an increase in deposits over the past week by 13.4 billion Swiss francs. This is the maximum growth since January 2015. Will EURCHF quotes rise?

The upward movement of this currency pair means the weakening of the Swiss franc against the euro. Market participants do not rule out that a significant increase in deposits may mean the Swiss Central Bank is inclined to take some measures to limit the further strengthening of its currency. The total amount of SNB deposits reached 650 billion Swiss francs. Let us recall that on April 23, EURCHF came close to the minimum again since July 2015. Changes in the SNB rate (-0.75%) are not yet expected. It is much lower than the ECB’s rate (0%). Note that the next meeting of the European regulator will take place on 30 April. Eurozone GDP data for the 1st quarter of 2020 and the preliminary inflation for April will be published at the same time. All this can support the euro. This week, KOF retail sales and indicators of business activity will come out in Switzerland.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.