- Analytik

- Technische Analyse

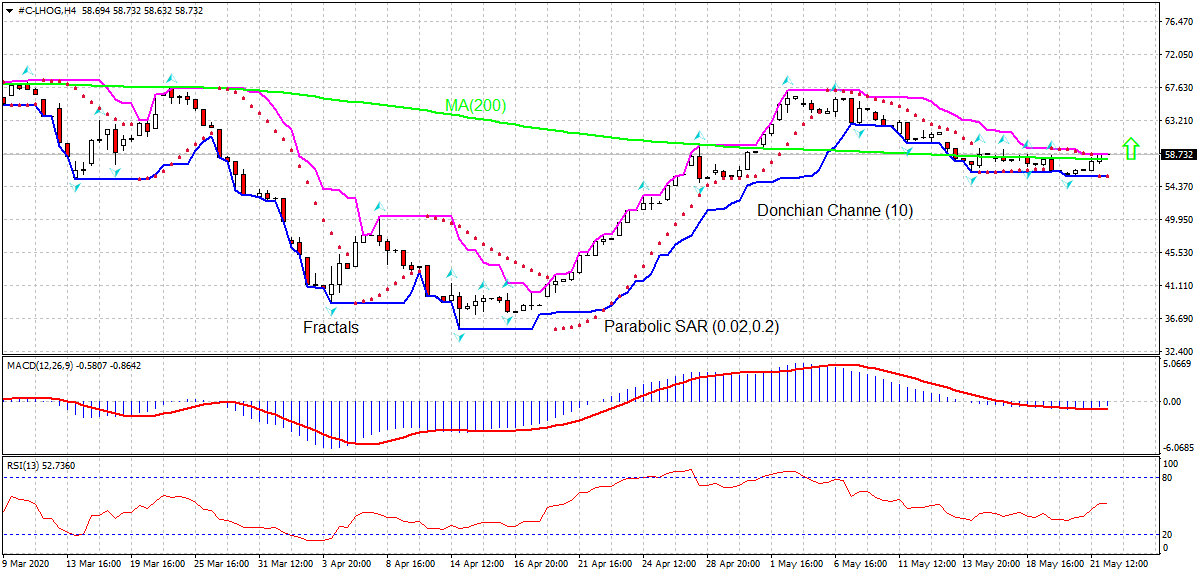

Magerschwein Technische Analyse - Magerschwein Handel: 2020-05-22

Magerschwein Technical Analysis Summary

Above 58.73

Buy Stop

Below 55.74

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Neutral |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Buy |

Magerschwein Chart Analysis

Magerschwein Technische Analyse

On the 4-hour timeframe #C-LHOG: H4 has breached above the 200-period moving average MA(200), which has levelled off. We believe the bullish momentum will continue as the price breaches above the upper Donchian boundary at 58.73. A pending order to buy can be placed above that level. The stop loss can be placed below 55.74. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (55.74) without reaching the order (58.73), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Rohstoffe - Magerschwein

Lean hog price is rising supported by rising Chinese imports following US-China trade deal. Will the LHOG continue rebounding?

China’s pork deficit due to African Swine Fever (ASF) has resulted in rising Chinese pork imports. China imported 95,892 tons of US pork, up 250% from a year ago, according to the US Meat Export Federation. And while China is working to rebuild its pig herd, analysts estimate China’s pork imports will continue to rise this year. China’s reported Q1 pork imports are up 118% to nearly 1.2 million tons. The US accounts for 23% while the EU remains the primary supplier with a 61% market share. Rising Chinese imports are bullish for LHOG. However, US pork prices are pressured by increasing supply as meat processing plants restart after covid-19 shutdowns. At the same time demand is lower despite coming Memorial Day holiday next Monday. American pork slaughterhouses were operating through Wednesday at 85% of year ago levels as workers returned to plants. Wholesale pork prices climbed for the first time in four days but are still 18% below a five-year high of $121.66 per 100 pounds, according to US Department of Agriculture. Rising US supply and lower demand are downside risk for pork.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.